H2 2024: Turning Tide or Treading Water?

TAKING STOCK OF FIRST HALF 2024 AND EXPECTATIONS FOR SECOND HALF

Bank of Canada (BoC) started cutting rates, while central banks in the U.S., and most of Asia Pacific held steady. For these latter economies, Q2 inflation and job data suggest a possible pivot in the months of Q3.

At the end of July and early August, the divergence in monetary policies—rate hold in the U.S., rate cut in the U.K., and rate hike in Japan—led to significant market volatility. We saw the unwinding of the popular carry trade (borrowing in Yen to invest in global risk assets), weakened dollar, and a drop in swap rates (excluding Japan), signaling lower borrowing costs and raising concerns about an economic slowdown.

In Asia Pacific, commercial property transaction volumes have improved in some markets, providing repricing evidence. In others where transaction evidence is still lacking due to a wide bid-ask spread, valuers are under pressure to avoid asset write-downs, but market-clearing prices significantly below current valuations may force adjustments.

With potential rate cuts on the horizon, buyer optimism could increase, helping to narrow bid-ask spreads. However, political uncertainties and their domestic and international implications are becoming more significant in decision-making.

INVESTMENT INTEREST TURNS TO MARKETS THAT ARE REPRICING

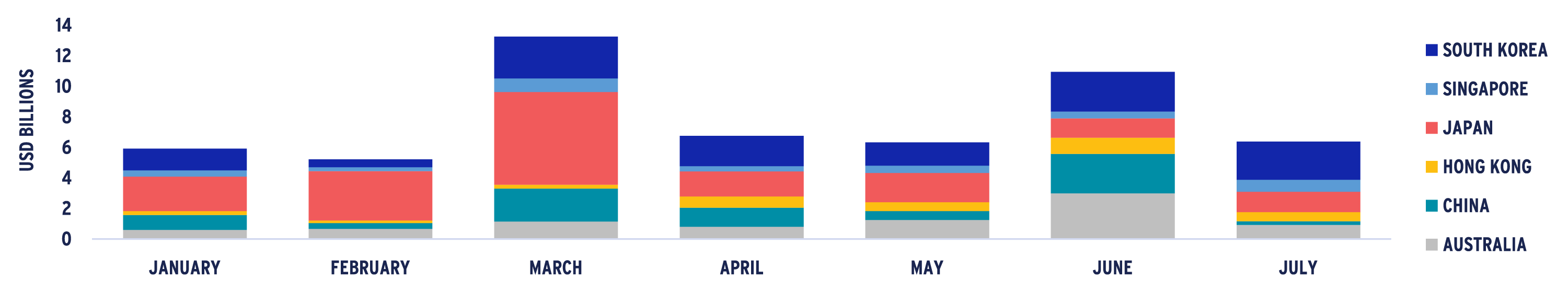

Up to July 2024, Asia Pacific investment volumes have largely been on pace with the activity from last year. In contrast, transaction activity in Europe is up about 10% vs the same time last year, meanwhile in the U.S. overall volumes seem to be lagging (about 18% below the same period last year)

In the Asia Pacific region, Japan dominated Q1, but the market slowed down in the following months; however, strong investment activity in the first quarter helped offset the subsequent decline.

Instead, between April to July, the spotlight on investment activity shifted to Australia and South Korea with large increases in the number of closed sales– still it’s important to note these closed deals have had significant timelines for negotiation, ranging from six months to a year, or more. Markets that are tracking significantly below last year’s liquidity levels, measured in local currency are Singapore (-48%) and Hong Kong (-11%).

Currently, the bulk of distressed deals, or those that have gone into receivership, are concentrated in Hong Kong and China. MSCI estimates that about 80% of the distressed deals in Asia Pacific YTD have been in China.

DIVERSE CYCLES, GROWTH & VALUE OPPORTUNITIES

As a rate-cutting cycle nears, investors and asset owners are becoming more optimistic due to expected relief in financing costs. Still, we expect higher rates for a longer period—debt will have a real cost going forward, making future returns more reliant on attractive entry points or asset-specific qualities. Asia Pacific's diverse investment landscape can offer opportunities across the risk spectrum, with markets like Japan, China, and Australia at different stages in their cycles.

Demand in office and industrial is expected to be weaker than historical averages, but clear occupier preferences today will likely lead to divergence in sector performance. Currently, investor interest is strongest in living, life sciences, and data centers, where demand conditions are likely most favorable. As capital flows shift, opportunities for mispriced risk in traditional asset classes may also arise.

We are optimistic about the 2024/2025 period and see opportunities across the risk spectrum, including the repricing of core assets, repurposing well-located properties for modern use, and capitalizing on market cycles with anticipated positive lease reversions.

INVESTMENT VOLUMES ACROSS KEY ASIA PACIFIC MARKETS YEAR-TO-DATE 2024

Source: MSCI, as of August 2024

Unsynchronized Rate Cycle Amid Weak Growth

GROWTH REMAINS TEPID WITH LIMITED TAILWINDS

Global growth forecasts for 2024 have slightly decreased since January. Weaker than expected inflation and job data from the U.S. in Q2 led to stock market selloffs and rekindled recession fears in early August; however, this was largely viewed as a market overreaction.

Nonetheless, growth remains tepid, with some positive momentum concentrated in sectors like AI and technology.

Asia Pacific’s major markets exhibit uneven growth prospects:

- South Korea’s chip manufacturing and exports continue to benefit from the AI boom, whereas Singapore's recovery is expected to be patchier, facing more competition from low-cost manufacturing in Malaysia.

- In Australia, population growth is heavily reliant on net overseas migration, but there are emerging immigration policy risks.

- For China, export growth is positive, but a slowing momentum in July is notable and speaks to fading of global discretionary demand.

- In H1, Japan’s growth was hindered by weak auto exports and yen-depreciation linked spending weakness; however, recent currency movements suggest this may ease in H2.

CONSUMER WEAKNESS APPARENT WITH UNIQUE DOMESTIC CIRCUMSTANCES

Unlike their Western counterparts, Asia Pacific markets tend to have more conservative consumer spending habits, with higher household savings rates. Retail sales have been weak across Singapore, South Korea, and Australia. In Hong Kong and China, declining housing prices and reduced asset wealth are worsening the situation, impacting consumer balance sheets and reducing spending.

While services consumption has remained relatively strong year-to-date, we anticipate moderation in the trend, particularly in tourism, with companies like Booking.com and Airbnb already reporting lower-than-expected earnings, signaling travel spending growth may slow after the summer peak.

In Asia Pacific, labor market slack is slowly increasing, and hiring intentions have further eased. Hiring sentiment for the next three months is weakest in Hong Kong and Japan. For Japan in particular, the increase in interest rates might lead to the end of many zombie companies, that were artificially kept alive by cheap money.

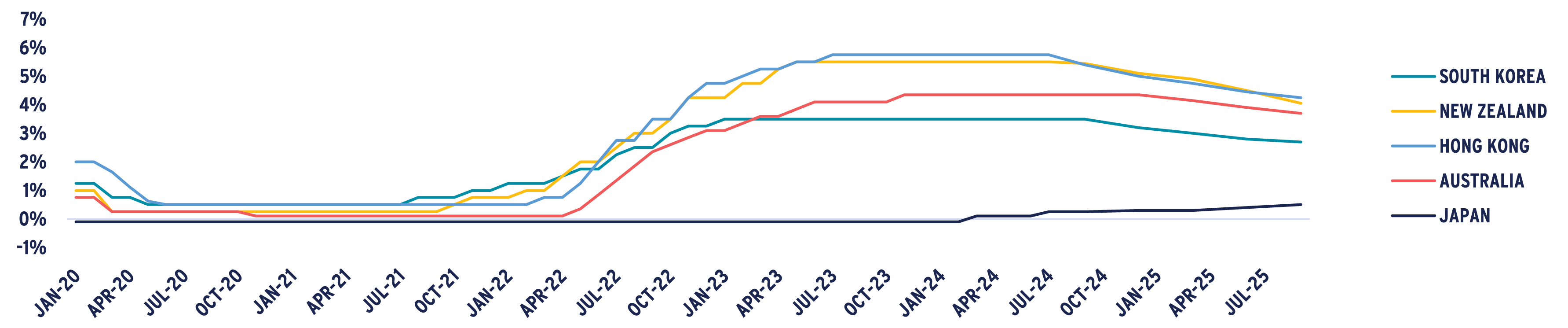

MONETARY POLICY EXPECTATIONS UNSYNCHRONIZED, POLITICAL UNKNOWNS CAN HAVE IMPACT

The rate-cutting cycle is unsynchronized globally. In Asia Pacific’s major markets, we see South Korea and New Zealand ahead of the curve, while Australia is likely to lag. Meanwhile, Hong Kong’s and Singapore’s interest rates will be closely tied to the outcomes from the Fed.

Meanwhile, the BoJ’s surprise hawkish hike at the end of July followed by a dovish tone several days after the market has led to more confusion about the outlook for rates – but base case remains for gradual normalization. The yield curve in Japan has essentially shifted upward, and this is expected to have an impact on transaction and appraisal cap rates in the coming years.

Asian currency weakness (and USD strength) has been a feature of currency markets over the last 3.5 years, but from the start of July, several Asian currencies posted gains against the U.S., a trend that is expected to continue.

POLICY RATE OUTLOOK KEY ASIA PACIFIC MARKETS

Source: Bloomberg & AEW Research, as of end July 2024

Investing for the Next Cycle

OFFICE

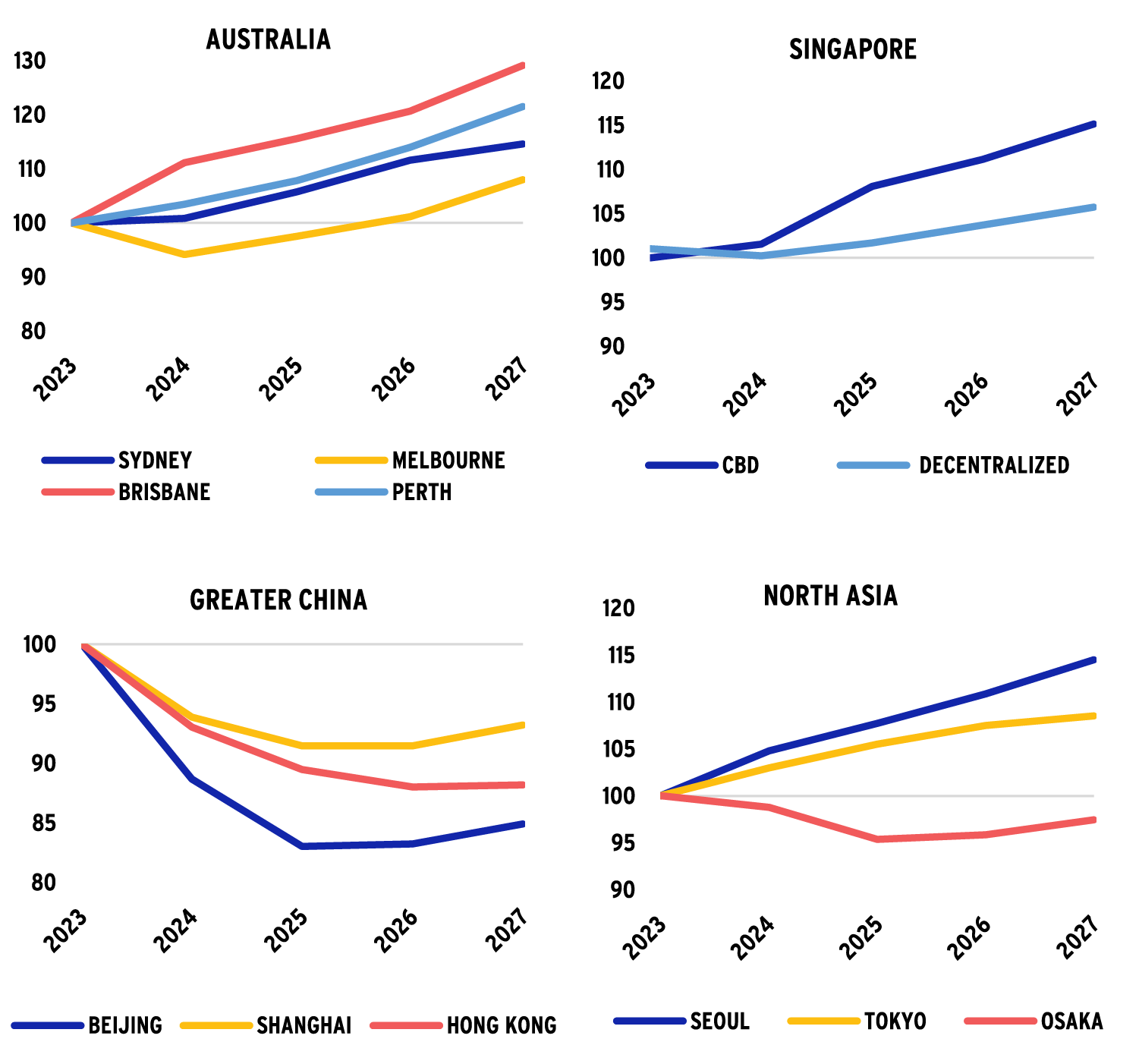

PRICING ADJUSTS AS LEASING CHALLENGES COME TO THE FOREFRONT; SOME MARKETS STAND OUT

The overall outlook remains challenging, with further near-term rental downgrades over the quarter, predominantly in Greater China, but also in Singapore, and several Australian submarkets. For the latter two countries, metro or decentralized markets are faring worse as leasing demand gravitates towards high quality assets in core locations. Leasing demand expectations have also been revised down by about 20% across several key markets since the start of 2024. However, there are some positive developments, particularly in North Asia and Brisbane, where upgrades (both in terms of demand and rent growth) continue.

Concluded deals from April to July have provided valuable repricing evidence with several deals closing in Australia after extended market negotiations. In Singapore, pricing resilience holds, however in South Korea, despite solid fundamentals, there have been sales at large discounts as asset owners run into financing trouble. In Japan, interest in the office sector is growing again, particularly for Grade A properties as occupier demand shifts favorably. In Greater China, market clearing prices have been significantly below valuations, with some bids occurring below loan value, signaling investors’ view of long-term weakness in the market.

INDUSTRIAL

OCCUPIER DEMAND NORMALIZES, INVESTORS REMAIN KEEN

Leasing demand has further reduced this quarter, in line with expectations. While last quarter we noted occupier leasing strategies moving away from “just-in-case” to “just-in-time” inventory management, increased shipping costs over recent months could force 3PLs to rethink this strategy. Still, we note an increase in shadow or sublease space across a number of markets, indicating the downsizing trend is predominant. The most landlord favorable conditions are still in Australia with vacancy below 1.5% but leasing today is mostly active in the 3,000 to 10,000 sqm size bracket. In North Asia where supply deliveries are peaking in 2024, leasing in new completions have slowed.

Despite the slowdown in demand, the industrial sector is still highly sought after by investors, with several large deals on the market in Singapore and Australia. In South Korea, distressed sellers are more common today, with several assets being marketed at or below replacement costs – these are assets that are likely to come with more complications.

RETAIL

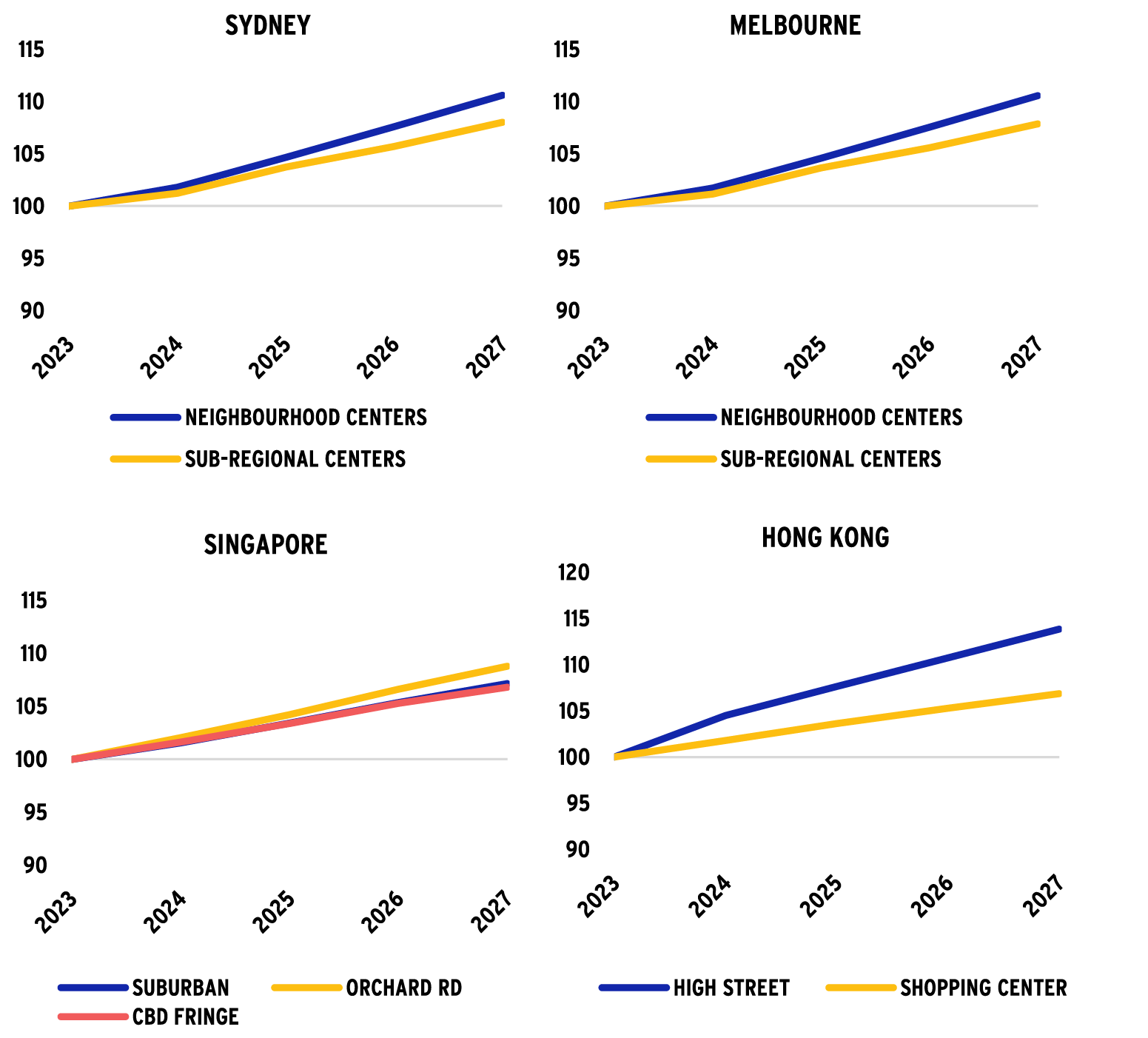

INCOME GROWTH POTENTIAL DESPITE SLOWDOWN IN RETAIL SALES WITH ATTRACTIVE ENTRY IN SOME MARKETS

Retail sales and consumer spending (including services) is already trending lower alluding to near-term challenges in the retail sector. Rental growth expectations are being tempered down in several markets, while vacancy rates in Hong Kong and Australia are trending up. While this points to a bifurcation between discretionary vs non-discretionary centers in coming months, unique conditions also present itself today, specifically in Australia and Singapore – supply is about 70% below historical averages, and many leases today are rolling off COVID lows to a market rent about 15 to 25% higher.

Retail assets are probably more frequently traded today than they have been in the last ten years. For Singapore, several large trophy assets are up for sale, however pricing is expected to be tight with yields south of 4%. In Australia, while pricing is attractive vs historical levels, recent transactions have been scattered in terms of a premium or discount vs 2023 Dec book values. Many of the listed players still hold the quality stock.

LIVING

OPPORTUNITIES IN THE LIVING SECTOR ARE BROADENING

The living sector is currently the standout in Asia Pacific real estate, driven by strong fundamentals like limited supply and pent-up demand, as well as alignment with demographic trends and evolving living preferences. Investor interest spans from short-to long-term stay apartments to age-restricted living. Japan's multifamily sector and Australia's student housing and built-to-rent (BTR) markets are leading, while investors have also pursued opportunities in co-living in Singapore and South Korea, and student housing in Hong Kong. Although these markets are still emerging, existing operating assets provide some proof of concept. However, more data on exit cap rates is probably needed to boost investor confidence.

Office

AUSTRALIA: SYDNEY- MELBOURNE GAP WIDENS, REPRICING FEEDS Q2 VALUATIONS

- The leasing disparity between Sydney and Melbourne is increasing with the former accelerating in core locations, but the latter languishing with more downsizing and consolidation in Q2. Brisbane continues its positive tear with vacancies expected to decline through to 2028 and upgraded rent growth expectations for 2024.

- Q2 was important in securing transaction evidence for office repricing. Stronger investor interest for Sydney is reflective of positive signals in leasing and potential recovery beyond 2025, while Melbourne could see a protracted price decline and bottoming out.

SINGAPORE: NEAR-TERM CHALLENGES BUT IMPROVEMENT EXPECTED

- A lack of positive demand tailwinds alongside large new supply in 2024 has tempered landlords’ bargaining power, but beyond 2024, these challenges could ease. Decentralized locations continue to suffer the spillover effects from business park vacancy as well as a broad tenant flight-to-quality and location.

- Strata office sales dominated Q2 transactions, but a notable enbloc sale in the CBD at 4% premium to 2023’s book value reinforces the assertion of price stability in this market.

HONG KONG: WEAK OCCUPIER MARKETS WHILE CAPITAL LOSS AND DISTRESS SALES INCREASE

- Six consecutive quarters of rental downgrades lower confidence in Hong Kong’s market. Vacancy levels today are around 14% (or 15 million sq ft) and with limited demand tailwinds and supply peaking in 2025, vacancy is expected to expand further.

- Distress and deep discount deals are commonplace, especially so in the office sector. Owners face challenges disposing assets in this environment of higher interest rates, strained occupier conditions, and lack of market participants. CBRE estimates about 75% of the deals completed in Hong Kong today are distressed or realizing capital losses.

CHINA: PROTRACTED WEAKNESS IN LEASING AND SALES

- Leasing demand has shrunk to about 40% of typical volumes seen prior to 2020. Given the backdrop of large new supply and prevailing cost consciousness from tenants, rents are expected to continue to fall over the next two years.

- Many assets are available for sale, but buyers are limited. Balance of risks are titled toward Shanghai where the volume of players wanting to sell is much larger. Those that have secured interest (typically from end-users or insurance companies) are stuck in an extended due diligence process.

SOUTH KOREA: VACANCY REMAINS LIMITED BUT SUPPLY RISK INCREASES IN THE CBD

- Rent growth momentum in Seoul office remains positive but is slowing. Still, we note leases reverting in 2024 and 2025 will likely offer attractive increases. GBD and YBD have lower supply risk vs the CBD submarket where a string of new completions is expected between 2025 and 2026 after no new completions for four years.

- With solid fundamentals, pricing has remained elevated, but there are also a handful of discount or distress opportunities from sellers with liquidity/ financing constraints.

JAPAN: RENT OUTLOOK UPGRADED, EXPECT MODERATE YIELD EXPANSION

- The near-term rental outlook in Tokyo has significantly improved in H1, driven by increased demand for premium and Grade A buildings. However, due to high fit out costs and lengthy installation works, this is mostly benefiting landlords of existing buildings, which are then able to increase rents. Meanwhile newer buildings are understood to be offering heavy incentives.

- Domestic investors remain active despite global aversion to the office sector. While yield spreads can be attractive and rent growth is expected over the next 12 months, gradually rising interest rates are likely to marginally impact returns.

OFFICE RENT INDEX 2023=100

Source: AEW Research, JLL, Q2 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

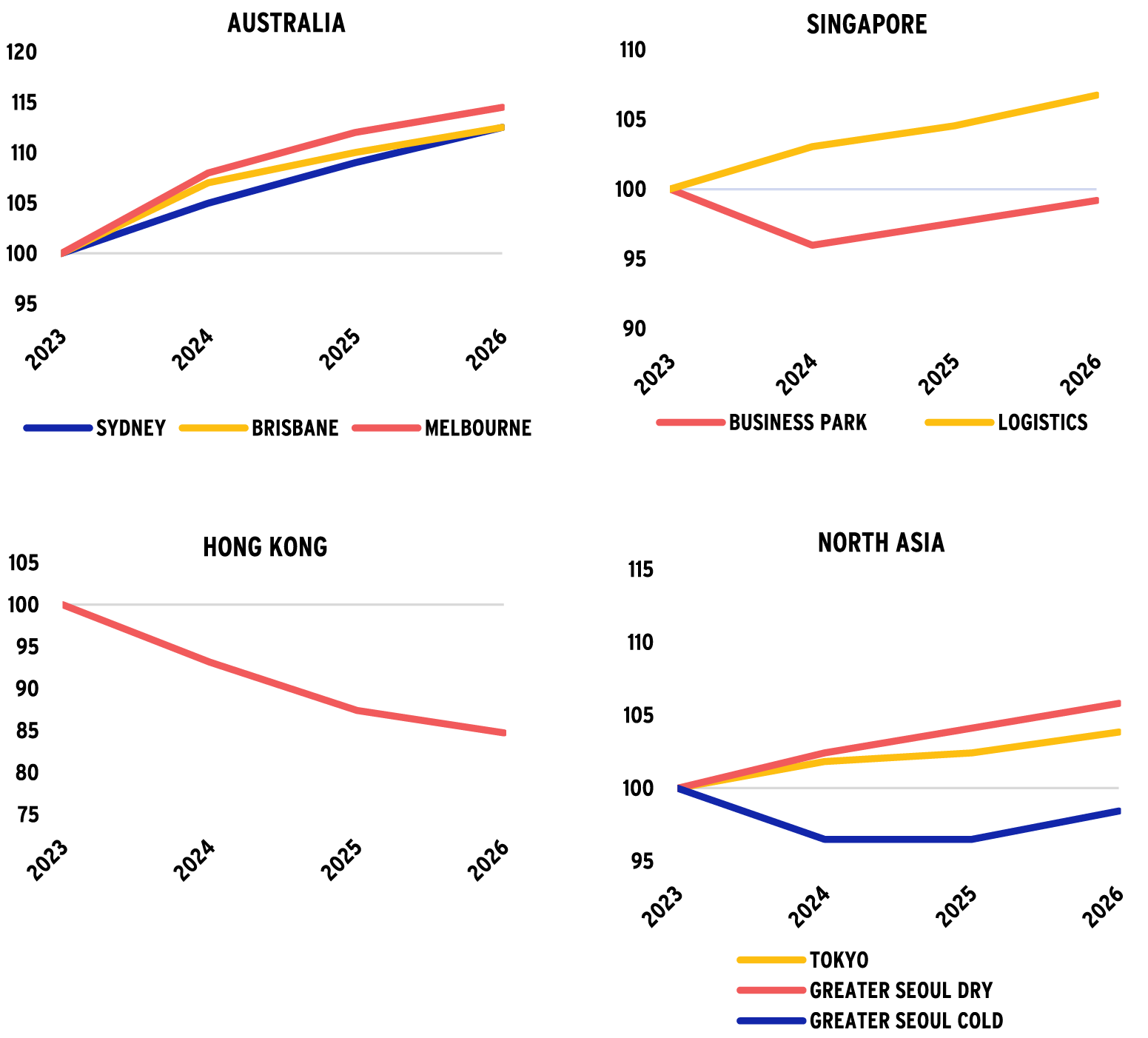

Logistics

AUSTRALIA: DEMAND SLOWS BUT VACANCY TO REMAIN LOW, INVESTOR INTEREST HIGH

- Demand is normalizing from rapid expansion over 2021 and 2023. Consolidation efforts by occupiers have increased, and leasing decisions are taking longer to conclude. This year, supply peaks in West Melbourne and Sydney will probably lead to a rise in vacancy levels, however, notably from global record lows of below 2%.

- Investment activity has rebased to long-term historical average volumes, after surges in 2021 and 2022, but some large portfolio sales in 2024-to-date indicate the sector is still strongly sought after. More interest in land transactions was witnessed especially by big institutions replenishing their land bank.

SINGAPORE: DIVERSE DYNAMICS - LOGISTICS, LIGHT INDUSTRIAL & BUSINESS PARKS

- After solid occupier conditions over the last two years, rental growth is expected to slow drastically. A reduction in e-commerce led demand has contributed to increased vacancy, which will likely result in more secondary space once new supply completes in 2025. Despite the market becoming softer, investors remain interested in the sector purely from an income perspective.

- Leasing in business parks and high-tech spaces continue to be challenged by downsizing and relocation to central areas, resulting in vacancy exceeding 30% to 40% in some eastern and western submarkets.

HONG KONG: DEMAND HEADWINDS INCREASE

- The outlook has turned particularly weak with limited growth from trade-related sectors and local consumption. Vacancy has increased to more than 7%, the highest historically, and is anticipated to further increase up to 2026.

- Liquidity improved q-o-q in Q2, but on an overall basis remains restricted. The government’s recent relaxation of LTV for non-domestic properties was expected to provide some uplift, but limited positive impact probably highlights a risk off sentiment for Hong Kong.

SOUTH KOREA: OCCUPIER DEMAND AND ASSET PRICING BIFURCATED

- New completions continue to outpace current demand. Cold storage facilities remain substantially weaker with vacancy rates ranging from 25 % to 30% across districts vs an average 15% for dry storage space.

- Investment activity has improved substantially in Q2, with more discounted and distress opportunities. Several opportunities on the market today are expected to trade below replacement cost. Investors continue to be selective on location and dry/cold split given market conditions.

JAPAN: BETTER CONDITIONS IN INNER-CITY LOCALE, INVESTMENT ACTIVITY TO MODERATE

- Leasing slowdown is apparent in Tokyo logistics, especially in recently completed projects. Pre-leasing activity also remains subdued, and we expect to see some bifurcation in rents between new and older facilities.

- The cap on drivers’ trucking hours has had limited impact on demand in Tokyo, but we understand that larger 3PLs are expanding to regional cities to close out gaps in trucking routes.

- Japan's cold storage sector is not well-institutionalized, presenting an opportunity to create modern, fit-for-purpose facilities, especially in port areas where aging stock is running at near-full capacity.

- The logistics market remains highly sought after, but investment volumes declined substantially after Q1’s record levels to just JPY54 billion.

LOGISTICS RENT INDEX 2023=100

Source: AEW Research, JLL, as of Q2 2024

There can be no assurances that any prediction, projection, or forecast will be realized

Retail

AUSTRALIA: WEAK CONSUMER BUT POSITIVE PROPERTY FUNDAMENTALS

- Australia is facing a consumer recession, with spending hindered by higher interest rates and inflation. Real retail sales have declined gradually since Q1 2023.

- The retail sector is at an interesting juncture. Despite weakening consumer conditions, large landlords are seeing positive leasing spreads, and retailers are benefiting from lower occupancy costs, enabling expansion. Future supply remains constrained.

- We believe these conditions alongside the attractive value available in the sector today have resulted in an increase in transaction markets, especially as some of the larger REITs trade out of partial ownership in some regional and sub regional assets.

- Retail yields have steadily widened since 2017, with yields exceeding the cost of debt. Private syndicates have been active buyers in the last couple of months, but foreign capital interest is also growing, with these groups typically working with local JV partners to secure deals.

SINGAPORE: LEASING DEMAND VARIED, SEVERAL LARGE ASSETS FOR SALE IN 2024

- As expected, retail sales lost momentum in Q2, an impact of higher inflation and the consumption tax hike. Tourist arrivals have also eased in Q2 and are unlikely to meet the government’s annual target of 15 to 16.5 million arrivals. Consumption leakage to Johor Bharu due to cheaper goods could also be a drag on local spending, especially for residents within the northern region.

- Leasing demand has been varied so far this year, but leases reverting from COVID lows and subsidy period are expected to see reversion of around 20 to 30%.

- A number of large retail assets have traded this year, at significant premium to 2023’s book value. We expect more sales significant scale in H2, as several have been launched for sale or being soft marketed.

HONG KONG: STRAIN ON LEASING AND TRANSACTION MARKETS

- Despite the improvement in inbound tourism, retail sales continue to underperform. Inbound tourists (overnight) from mainland China are spending about 20% below 2018 averages, while same-day tourists are spending about 45% less.

- Domestic spending is further detracted by outbound travel, with many Hong Kong residents shopping in Southern China, especially Shenzhen, for better discounts, leveraging the strong Hong Kong dollar.

- Although some occupiers are expanding their footprint due to cheaper rents, the overall sentiment in the leasing market remains weak, with downgraded rent growth expectations in the near term. The rental outlook for high-street is more positive due to its scarcity in prime locations.

- In the transaction space, non-institutional domestic investors are buying high-street and strata retail at steep discounts. Several strata sales were recorded in H1 2024, with notable transactions sold at 20-50% below their 2017/2018 prices.

RETAIL RENT INDEX 2023=100

Source: JLL, as of Q2 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

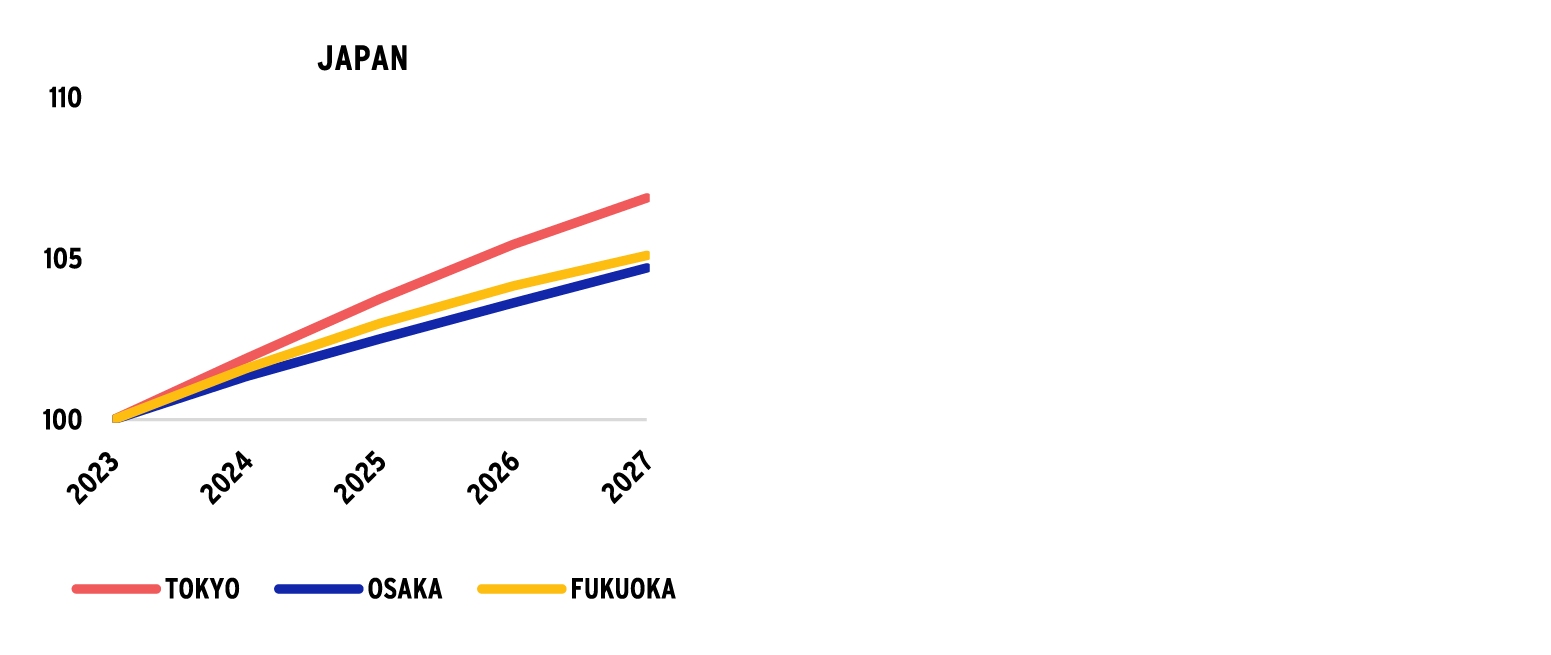

Multifamily

JAPAN: STRONG DEMAND AND RENT GROWTH BOLSTER NEAR-TERM CV GROWTH

- Driven by corporate hiring, wage growth, and increased office attendance – both domestic and foreign population growth in main city areas is rising, most of all notable in Tokyo’s 23 Wards. Net migration in H1 2024 has already surpassed 2023’s full year figures in Tokyo and Osaka.

- Inner-city leasing conditions have strengthened compared to last year, with a renewed demand for units in areas with easy access to CBD locations – these units are typically smaller-sized, between 15 and 30 sqm and as a result have seen the strongest rent growth y-o-y.

- For the leasing environment in 2024, there has been less emphasis on larger living spaces, a trend that we initially saw develop post the acute pandemic period.

- Rental growth is expected to move in line with wage growth, providing landlords a cushion against rising maintenance and financing costs.

- Investor interest in the sector remains strong, but portfolio deals are less common. Most investors already have significant exposure and prefer to cherry-pick assets to supplement their existing portfolios rather than seeking immediate scale.

- Yield expansion in a rising rate environment in Japan would be inevitable. Yields are expected to stay stable in the near-term, with rental growth supporting increases in capital values. Beyond 2024, there could be mild expansion, more so in the regional cities.

MULTIFAMILY RENT INDEX 2023=100

Source: PMA, as of Q2 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

For more information, please contact:

HANNA SAFDAR

Head of Research and Strategy, Asia Pacific

hanna.safdar@aew.com

+65.6303.9014

JAY STRUZZIERY, CFA®

Head of Investor Relations

jay.struzziery@aew.com

+1.617.261.9326

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.