Navigating Between Optimism & Caution

MAKING GAINS BUT STAYING CAUTIOUS

As we near the end of 2024, we are left with mixed news and perspectives. On the positive side, several weeks have passed since the Fed’s 50 bps rate cut, and expectations for further easing are emerging in Asia Pacific. JP Morgan notes a rise in IPOs for private equity firms in Q3 in the U.S. and we are seeing similar optimism in Asia Pacific. Additionally, a major China stimulus plan (although details and efficacy are yet to be seen) could prompt a quicker recovery in China. Transaction activity has also increased in Asia Pacific, particularly in Australia and South Korea, suggesting markets may be reviving after months of stagnation.

While there are clear signs of market recovery and growth opportunities, the path forward remains uncertain. Rate cut expectations could see further delays, China’s liquidity trap may not be easily solved by the government’s stimulus plan as confidence will take some time to build. Lastly geopolitical tensions and threat of a regional war in the Gulf could have severe economic implications globally. Balancing optimism with prudence will be key as we navigate the coming months.

LIQUIDITY IMPROVES, PUBLIC REIT GAINS ARE A GOOD PRECURSOR FOR PRIVATE MARKETS

Public real estate markets in the Asia Pacific region, particularly Australia, Hong Kong and Singapore, turned positive from July 2024, despite some volatility. The shift was driven by anticipated Fed rate cuts and China’s announcement of stimulus measures. If sustained, this momentum could set a strong precedent for private real estate markets, which typically lag their public counterparts by 9- to 12- months.

In Q3 2024, investment activity surged after a steady H1, with the USD16bn AirTrunk acquisition boosting volumes by 42% from the same period last year. Even without this deal, investment volumes were up 18%, contrasting with a 10% decline in the U.S. and Europe.

Australia and South Korea were the focal points in Q2 and Q3. Australia’s office sector saw renewed interest starting in June, reinforcing repricing trends, while retail investment remained steady, with total volumes up 50% year-on-year. In South Korea, office transactions mirrored strong occupier conditions, with foreign capital stepping. Foreign interest also grew in the industrial/logistics sector as more discounted opportunities emerged, underpinned by optimism around a cyclical recovery in dry logistics.

Japan, which led investment activity in Q1, saw a slowdown in transaction volume in the subsequent months, but as interest rates rise, we should see more active sellers. Singapore, meanwhile, was relatively quiet aside from a couple of large portfolio deals, though there has been a recent uptick in strata-titled office sales in the central areas. In China, assets are increasingly being sold at a loss or steep discount, and in Hong Kong, local veteran investors are divesting amid a broad-based slump and high debt costs.

DIVERSE CYCLES, GROWTH & VALUE OPPORTUNITIES

Financing costs have eased, with 2-to 5-year fixed swap rates declining by an average of 70 to 80 basis points compared to their peak a year ago, providing some relief. Investors with capital are becoming more eager to deploy, timing their market entry carefully while balancing existing uncertainties. 2024/2025 is likely to be seen as a strong period for investment, much like 2009/2010 at the beginning of the rate-cutting cycle. Despite this optimism, fundraising activity is currently the slowest it has been since 2010.

At this point, there are opportunities arising from mispriced risks, particularly in cyclical sectors or those facing oversupply challenges. This creates a chance to acquire assets below replacement cost from sellers, a rare market condition not seen since the Global Financial Crisis. These opportunities are most prevalent for assets built or acquired at the previous market cycle's peak.

Meanwhile, structural trends that are considered more resilient to economic downturns, such as digital infrastructure, demographic shifts, and aging populations, are driving interest toward alternative real estate sectors. These include living strategies, healthcare-related assets, and data centers. While some opportunities exist through conversion strategies, most are accessible through new developments, which require capital with a higher risk tolerance.

Tepid Growth With Mixed Outlook, China Stimulus Surprise

GROWTH REMAINS TEPID WITH LIMITED TAILWINDS

Growth expectations have shifted: The U.S. economy has defied recession predictions, with recent jobs and consumer data showing resilience. Markets in Asia-Pacific have been mixed, but recession risks are lower than where they stood at the start of the year.

With rate cuts in Asia-Pacific expected only in Q4 2024, consumer weakness lingers across the region, although robust export activity, particularly in Singapore, South Korea, and China, provides some balance.

Japan is structurally shifting, with consumer health improving and business confidence rising, as reflected in the Tankan Survey, a quarterly business sentiment survey by Japanese corporates, gauging views on future economic conditions.

China, along with Hong Kong, could see growth forecasts to the upside, hinging on a yet-to-be-finalized stimulus package.

While short-term volatility is inevitable, we believe long-term macro trends still support a positive outlook for the region:

- Asia is trading more within itself: China's exports to the U.S. and Europe have dropped significantly, but its share of trade with Asia-Pacific economies has risen from 15% a decade ago to nearly 22% today.

- Government-led growth: Developed Asia-Pacific economies have launched strategic initiatives, boosting future growth in high-value sectors like electronics, biotechnology, R&D, and quantum technology.

- Australia stands out for population growth, expected to exceed 1.5% annually over the next five years. Despite some policy risks, even the downside scenarios suggest a solid population increase – which will likely have a key multiplier effect on the demand for real estate.

REMAIN CAUTIOUS ON IMPACT OF CHINA STIMULUS

The major news from late September was the Chinese government's coordinated effort to boost growth, seen as China's "whatever it takes" moment after several years of incremental but ineffective policy.

Even with monetary stimulus and additional housing market support announced, we are still in the preliminary stages of understanding the fiscal package. With limited details, speculation suggests stimulus between RMB 3 to 10 trillion, including debt transfers from local to central governments, infrastructure spending, recapping of large banks, and consumption handouts.

We remain cautious about the effectiveness of these measures, as the confidence drag will take time to recover. If consumption and import activity in China improves, regional markets stand to benefit, mainly through trade.

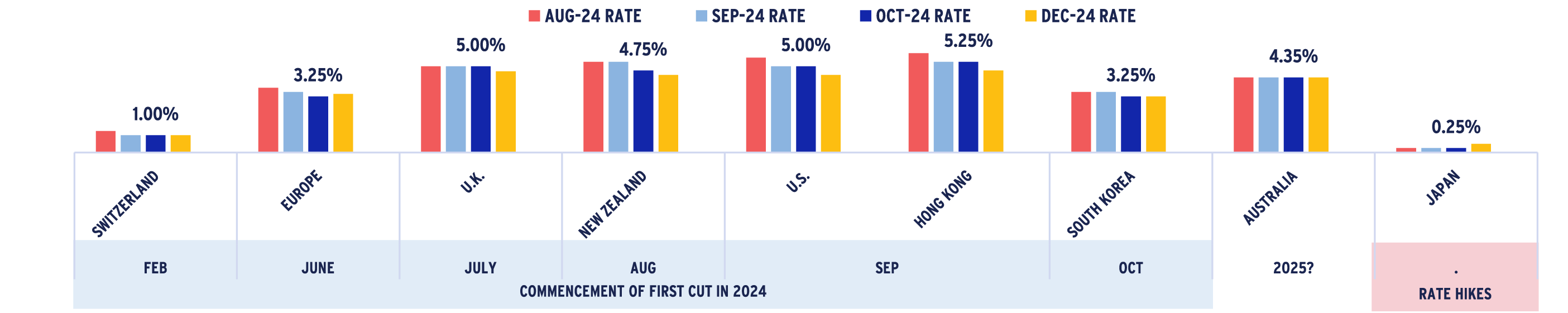

MONETARY POLICY EXPECTATIONS UNSYNCHRONIZED, POLITICAL UNKNOWNS CAN HAVE IMPACT

Asia-Pacific lags in the rate-cutting cycle, but the Fed's recent 50-basis-point cut provides room for regional economies to make downward adjustments. Hong Kong has benefited from the Fed's rate cut, with the HKMA following suit. However, major valuation challenges and declining rental income in various sectors mean the market will take time to recover.

South Korea saw some expected policy easing in October. While the MAS in Singapore has yet to loosen, there is relief from falling swap rates which has positively supported investment sentiment.

Australia remains behind in the cycle, a view held for some time due to its tight labor market, housing bubble, and the Reserve Bank of Australia (RBA)’s concerns over services inflation.

In Japan, the consensus is for a December 2024 hike has shifted further into 2025, following a dovish shift in tone from the BoJ governor and recent political election results.

GLOBAL RATE CYCLE TIMELINE

Source: Bloomberg & AEW Research, as of Oct 2024

Diverse Demand, Supply, Policy and Risks

Office

LEASING CHALLENGES REMAIN; SOME MARKETS STAND OUT AS CYCLICAL PLAYS

The messaging around occupier movements remains consistent. The "flight to quality" trend continues as companies aim to meet ESG goals and encourage employees to return to the office. While some large corporations have announced plans for more regular office attendance, we do not anticipate a significant change in office utilization from here. Vacancy rates, with the exception of Seoul and Brisbane CBD, remain below the ten-year historical average. In Sydney's CBD, we saw further signs of a potential recovery, with net absorption exceeding 100,000 sq ft for the third consecutive quarter. In Japan, demand and rent growth forecasts in the near-term are being upgraded, reflecting a broadening positive business outlook.

Although office investments are not a favored sector, interest in Sydney’s CBD has increased, and both domestic and foreign capital continue to show strong interest in Seoul. Looking ahead, investment strategies will focus more on micro-locations, with greater scrutiny to identify out performers.

Industrial

OCCUPIER DEMAND NORMALIZES, INVESTORS REMAIN KEEN

Demand continued to slow in Q3, reinforcing the broader economic sluggishness and consumer appetite. This decline in demand has led to rising incentives, even in low-vacancy markets like Australia. Rental forecasts for Sydney have been slightly downgraded due to affordability concerns, while the outlook for Greater China (including Hong Kong) has worsened, with heightened risks from geopolitical tensions and protectionist trade policies.

Investor sentiment in the sector remains positive, although it has declined from 12 months prior. Australia and South Korea (dry logistics) are favored as they have repriced, while Japan and Singapore are stable markets with solid income. Specialized industrial sectors are also seeing more investment activity - these include cold storage in key markets (excluding South Korea, where the sector is overbuilt), self-storage facilities (despite potential policy and land zoning risks), and data centers, which are vital to the growth of cloud computing and artificial intelligence.

Retail

SPENDING PATTERNS SHIFT ACROSS MARKETS, MORE INVESTOR INTEREST IN AUSTRALIA

Retail sales and consumer spending, including services, have been trending down for several months. However, interest rate cuts may inject more liquidity and boost consumption. Despite this, rental growth expectations are being lowered for structural reasons, particularly in Singapore and Hong Kong, where we are seeing consumption activity spread to nearby markets like Johor Bahru and Shenzhen. Still, the sector looks interesting today, particularly in Australia, where supply is about 70% below historical averages. Many leases signed during COVID are now expiring, with market rents currently 15% to 25% higher. Meanwhile, Tokyo’s and Seoul’s high-end retail markets are benefiting from strong tourism and spending, leading to positive rent growth after years of stagnation.

Retail assets are now traded more frequently than in the past decade. In Greater China, assets are being acquired at steep discounts, In Australia, pricing remains attractive, but discount opportunities are narrowing.

Living

OPPORTUNITIES IN THE LIVING SECTOR ARE BROADENING IN ASIA PACIFIC

The living sector is supported by strong fundamentals, including limited supply, pent-up demand, alignment with demographic trends and changing living preferences. Investor interest ranges from short- to long-term stay apartments to age-restricted housing. Japan's multifamily sector and Australia’s student housing and build-to-rent (BTR) markets are leading the way, though the latter two face some policy risks and inefficiencies as Australia addresses its housing crisis. There is also growing interest in expanding living strategies (co-living / student housing) in markets like Singapore, South Korea, and Hong Kong. Notably, some policy support has emerged, aimed at increasing land supply or facilitating capital participation. While these markets are still in the early stages, existing operational assets provide proof of concept. However, more data on exit cap rates is needed to enhance investor confidence.

Office

Australia

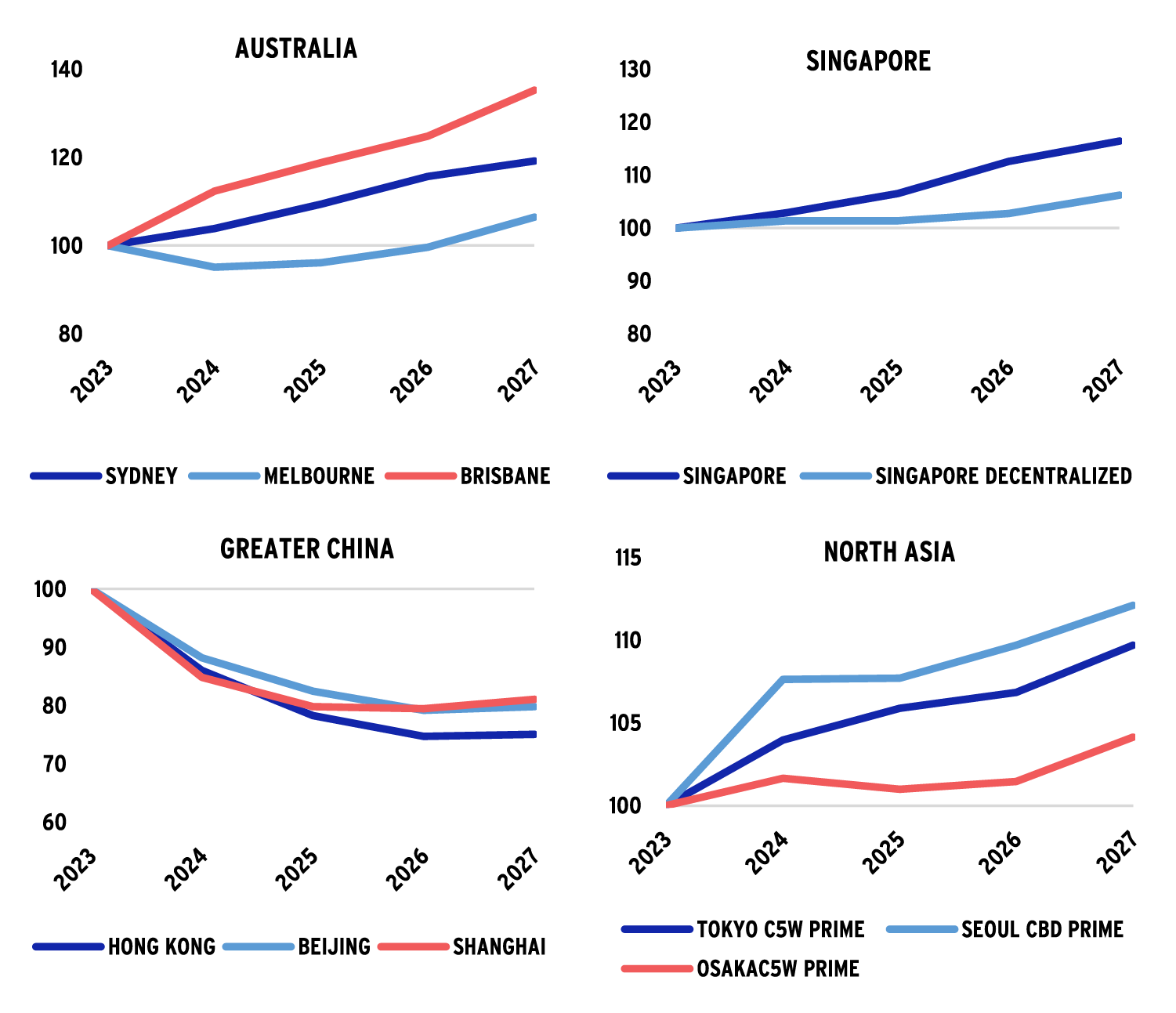

MELBOURNE LAGS, BRISBANE AND SYDNEY RUN AHEAD

- Brisbane continues to experience positive momentum while Sydney's leasing has improved as the return-to-office broadens out. In Melbourne, the consolidation trend has slowed, but the city's recovery is lagging with vacancy approaching 20%.

- Transaction momentum and re-pricing for Sydney’s CBD are evident with five large office deals completed since June 2024. Institutional capital is becoming increasingly confident with attractive entry and return to normalized market conditions.

Singapore

RENT CYCLE TO IMPROVE IN 2025, LIMITED ENBLOC INVESTMENTS YTD

- Rents remained stable in 2024 amid rising vacancies. We expect recovery by 2025, driven by stronger demand and a 40% reduction in four-year forward supply vs the 2021 to 2024 period.

- Investor sentiment improved after the Fed's Sep rate cuts but expect delayed interest in enbloc offices where cap rates remain below carrying costs. Currently, the strata market, supported by private capital and owner-occupiers, remains active.

Hong Kong

MORE DISTRESS AND CAPITAL LOSS SALES

- Rents are down 45% from peak, vacancy at a record 14%, and new supply in 2025 is expected to be 2.5x the past five-year annual average. Market sentiment remains weak, and it may take years to absorb the excess vacancy and stabilize.

- The sector faces significant valuation challenges. Property owners are facing challenges with falling rental income and debt payments, while banks have tightened their borrowing conditions. Over 50% of sales in 2024 have been distressed or at a capital loss.

China

PROTRACTED WEAKNESS IN LEASING AND SALES

- Expanding vacancy and tenant cost-consciousness have made substantial rent reductions and incentives common. Rents are now 25-30% below their 2019 peak, marking 30 consecutive months of decline. The outlook remains challenging, with 26 million square feet of new supply expected over the next two years.

- Assets are being offered at significant discounts, but buyer interest is limited. So far in 2024, purchasing activity has been largely driven by domestic players, with only a few sales involving cross-border capital, mostly from Hong Kong. It may be too early to gauge the impact of recent stimulus, but given geopolitical tensions and alliances, the pool of potential property investors is substantially smaller than the 2017 to 2019 average.

South Korea

SUPPLY DELAYS COULD EXTEND RENT CYCLE

- Rent growth momentum slows as affordability pressures increase. GBD and YBD face lower supply risks, but in the CBD, new supply due between 2026 and 2028, could get delayed, potentially extending landlord-favorable conditions.

- Pricing remains elevated, with several deals completed between July and September supporting this trend. Discount or distressed sale opportunities from sellers facing liquidity or financing constraints are rare but do exist.

Japan

RENT OUTLOOK UPGRADED AGAIN, EXPECT MODERATE YIELD EXPANSION

- Limited office supply and improved demand in 2024 have driven a stronger-than-expected rent cycle. Demand continues to broaden, and despite the large supply forecast for 2025, rental growth could extend through this period.

- The transaction market has cooled down substantially from the start of the year. While yield spreads are attractive and rent growth is expected over the next 12 months, gradually rising interest rates are likely to marginally impact returns.

OFFICE RENT INDEX 2023=100

Source: AEW Research, JLL, Q3 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

Logistics

Australia

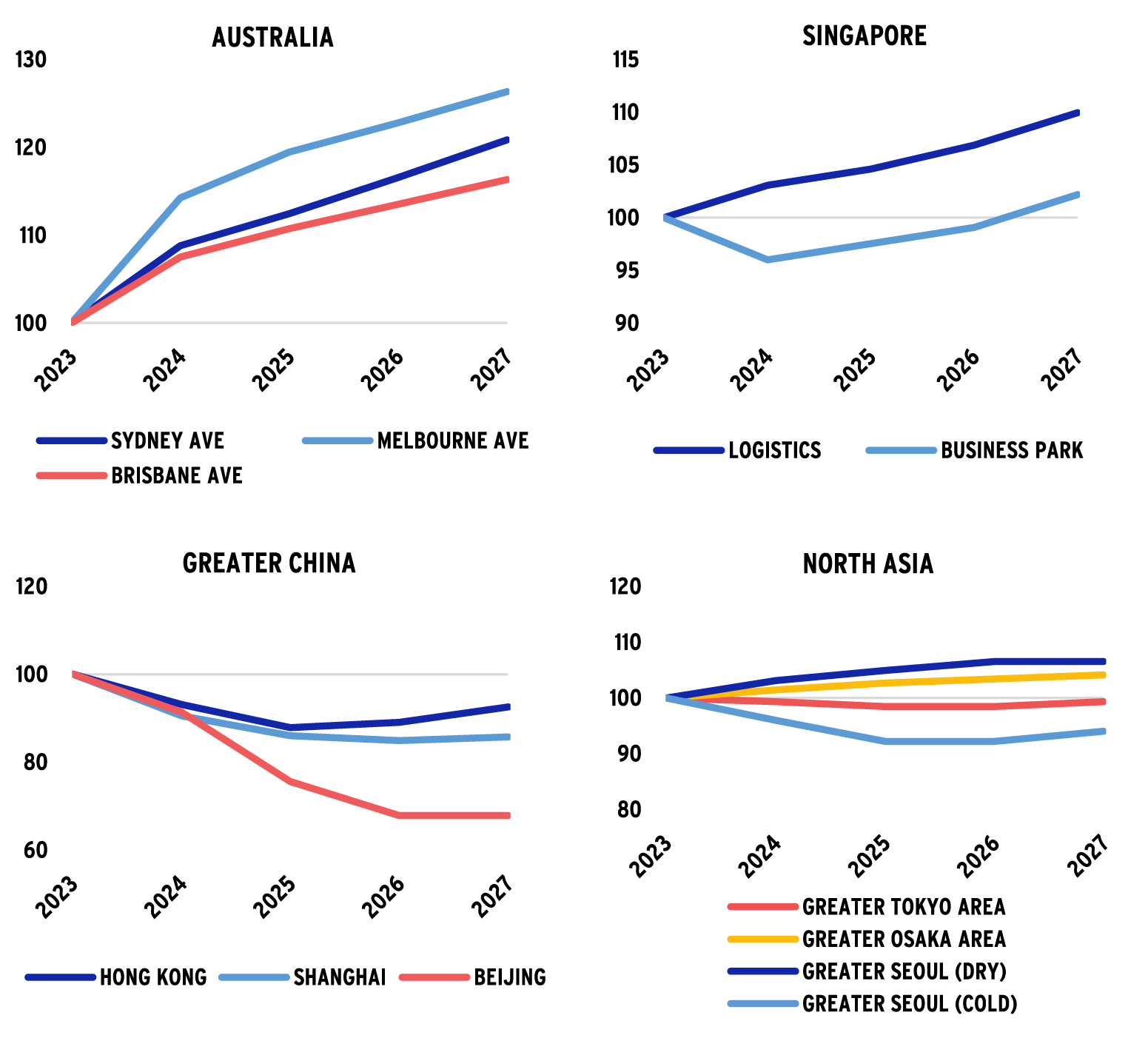

DEMAND SLOWS & INCENTIVES INCREASE, YIELDS AT CYCLICAL PEAK

- For the first time since 2019, full-year demand across eastern seaboard markets is expected to be below the ten-year historical average. Vacancy rates and incentives have increased as leasing conditions shift slightly in favor of tenants. However, face rents continue to rise, with rent reversion ranging from 35% to 40%.

- Yields have likely peaked, having expanded by 180 to 200 basis points since mid-2022. We anticipate that yields will remain stable for the rest of 2024, with the possibility for mild compression after the second half of 2025.

Singapore

DIVERSE DYNAMICS - LOGISTICS, LIGHT INDUSTRIAL & BUSINESS PARKS

- Rental growth in prime logistics will likely lose momentum in the near-term, especially given current occupier cost-sensitivity. Despite a softer occupier market, investor interest remains strong, driven primarily by yields that exceed funding costs.

- Business parks and high-tech spaces present more challenging occupier conditions as downsizing/ right sizing and centralization is blowing out vacancy. The partial completion of Punggol Digital District is also adding to excess vacancy and should exert downward pressure on rents in the near-term.

Hong Kong

DEMAND HEADWINDS INCREASE, LIQUIDITY RESTRICTED

- The industrial sector in Hong Kong has been the most stable of the three sectors (including office and retail), but is not immune to challenges. Hong Kong’s locational advantage and role as a transshipment hub meant occupiers were willing to pay a premium for rents but today other cities in the Greater Bay, and even SEA, are competing with good infrastructure, newer facilities, and more affordable rents. Vacancy has increased to 8% in Q3, the highest historically, due to more downsizing and early termination of leases.

- Liquidity has been restricted, but several large cross-border deals announced over Q3 have pushed up volumes transacted year-to-date. Capital values are down about 15% over the last two years but could have further room to decrease given structural issues in demand.

South Korea

OCCUPIER DEMAND AND ASSET PRICING BIFURCATED

- The gap between cold and dry storage is widening. Cold storage faces vacancy ranging from 30 to 40% and sluggish leasing, while dry storage, with 15% vacancy, sees stronger leasing activity.

- To encourage demand in cold, incentives of three- to six-months per annum are typical. There are also increasing anecdotes of cold chambers temporarily leased as "dry space" to manage occupancy since conversions are not cost-effective.

- Rental weakness has persisted but occupier markets may favor landlords by 2025 due to a rapidly declining supply outlook. This is mainly in dry storage, where demand is stronger.

- Investment activity has picked up with discounted and distressed opportunities below replacement cost. Investors are selective, focusing on location and terms to minimize leasing risk.

Japan

BETTER CONDITIONS IN REGIONAL CITIES, INVESTMENT ACTIVITY MODERATING

- Leasing slowdown in Greater Tokyo is apparent with vacancy increasing in completions less than a year old. Meanwhile, due to restrictions on drivers’ trucking hours, larger 3PLs are expanding into regional cities supporting demand. As a result, the rental outlook in Osaka, Nagoya, and Fukuoka now outpaces Tokyo.

- Although the logistics market remains in high demand, investment volumes have dropped significantly since Q1's record levels.

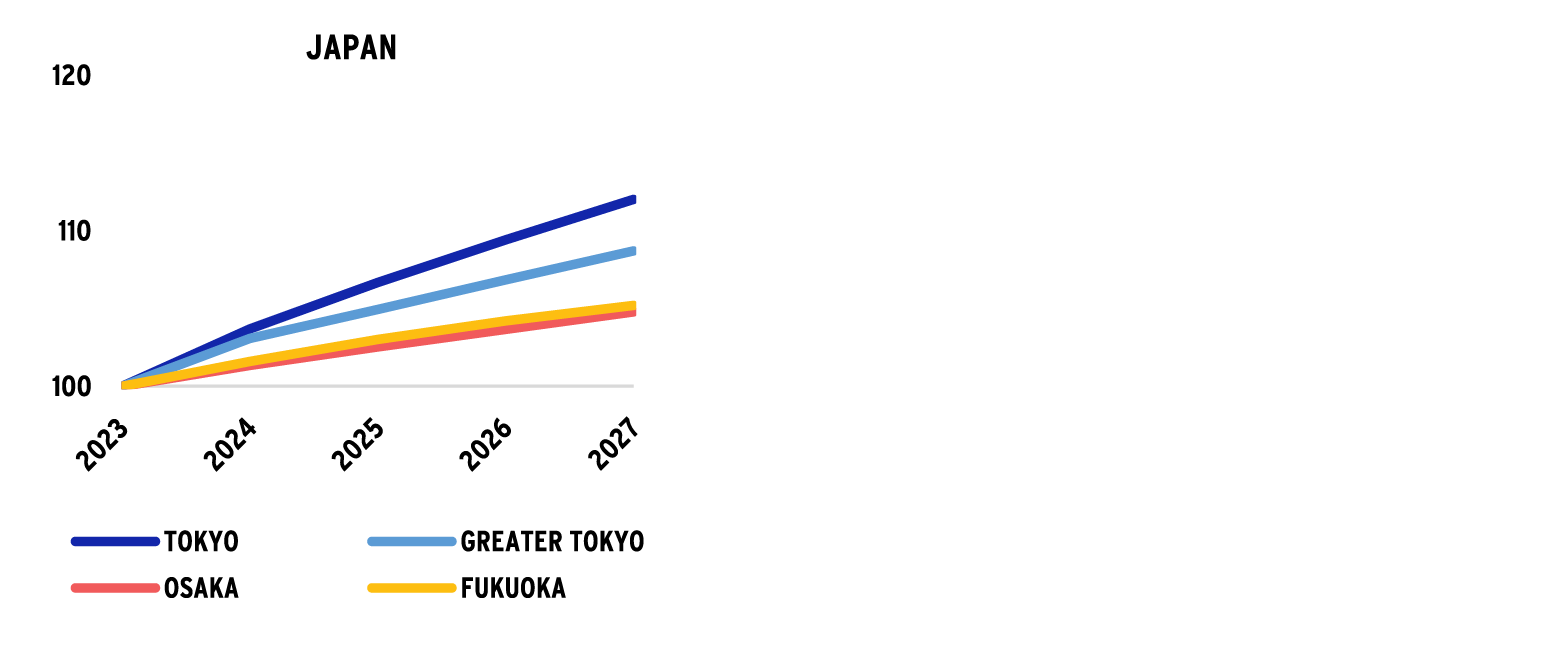

LOGISTICS RENT INDEX 2023=100

Source: AEW Research, CBRE, JLL, as of Q3 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

Retail

Australia

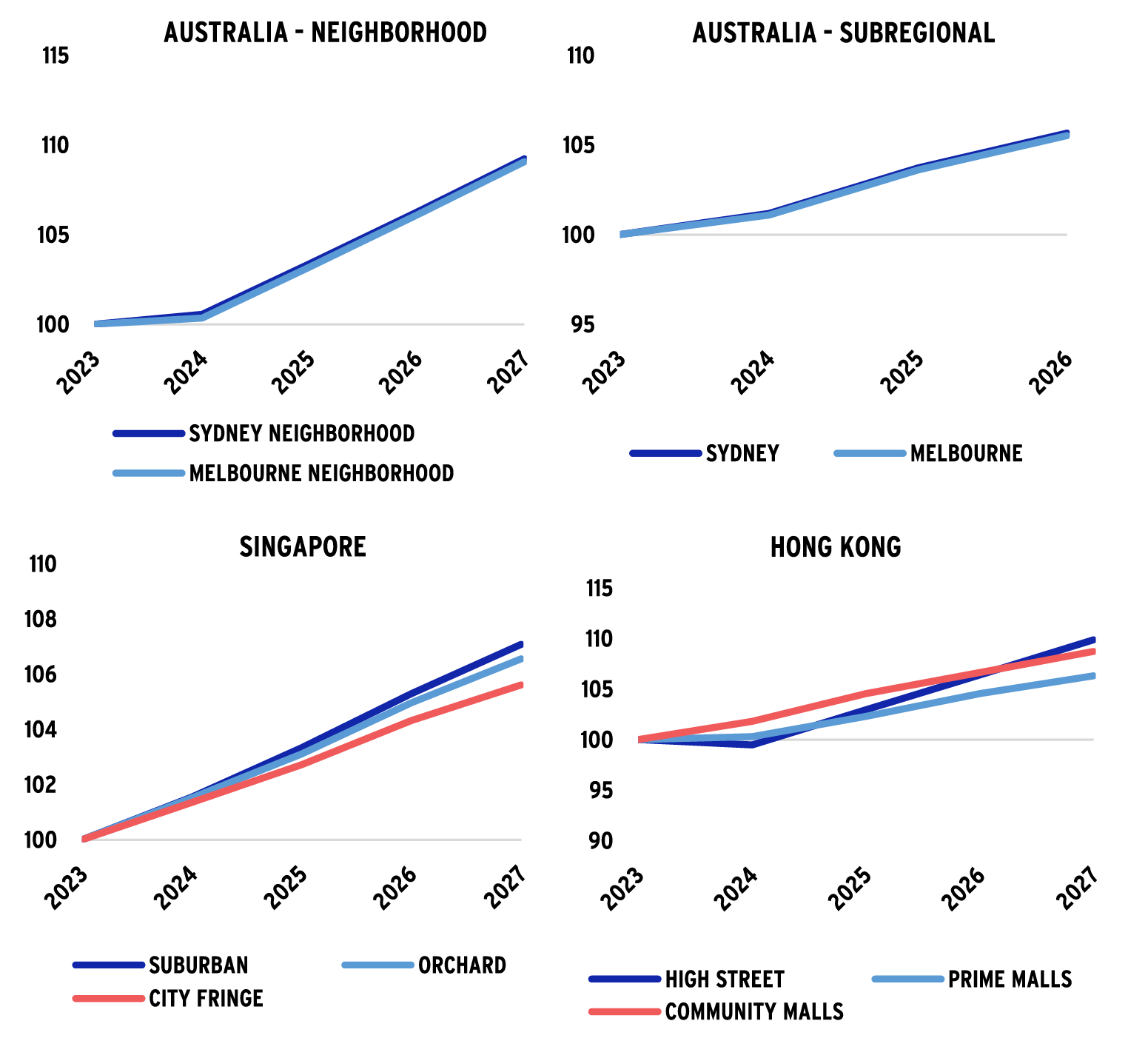

RATE CUTS COULD BOOST CONSUMER SPENDING

- The total return outlook for Australia's retail sector is the strongest it has been in a decade. Correspondingly, 2024 YTD investment volumes are up 60% compared to the same period last year.

- Despite concerns about consumer weakness and future employment, attractive entry points and supply levels of 70% below historical averages make for a compelling case.

- Large A-REITs are experiencing narrowing lease reversions, suggesting a potential closing window of opportunity. However, declining interest rates from 2025 could boost consumer demand, offering further tailwinds.

- Net face rents rose across all sectors in Q3, with large-format assets seeing the highest growth at 3.5% a quarter-over-quarter. Super prime CBD assets saw minimal growth at 0.1%, with ongoing pressures limiting CBD rental increases.

Singapore

SUBURBAN RESILIENCE BUT RISING CHALLENGES

- Retail sales have dipped in recent months, but suburban malls remain resilient with rents and occupancy rates flat over the quarter. Major events like the F1 in September attracted tourists, but it is understood the tourism spending per capita is declining.

- Caution is warranted as sales leakage to Johor grows, where goods and services are about 50% cheaper than in Singapore. The rapid transit system (RTS), set to connect Singapore’s northern tip to Johor by 2026, could reduce travel time to 15 minutes and potentially cause SGD 2.1 billion in annual sales leakage. Also worrying is that F&B cessations have increased to 200 per month over the last year, exceeding the record set over pandemic years.

- Transaction volumes in Singapore are at a three-year low, with several large assets remaining unsold for months.

Hong Kong

STRAIN ON LEASING AND TRANSACTION MARKETS

- Hong Kong retail sales have declined for six straight months as more residents shop and seek entertainment in Shenzhen, a trend amplified over the summer and during the Mid-Autumn Festival.

- Retail rents reversed several quarters of positive growth in Q3, as we noted more business closures, especially among SMEs, which have driven vacancies in prime malls and high streets to 10% and greater than 10%, respectively. Several international fashion brands have taken advantage of lower rents to enter the market over this period.

- The retail sector needs external factors for recovery, and it is too soon to tell if the recent stock market rebound will be sustained and eventually boost spending.

In the transaction market, non-institutional domestic investors have been buying high-street and strata retail properties at steep discounts. Some larger properties were also sold in Q3, though heavily discounted.

RETAIL RENT INDEX 2023=100

Source: JLL, as of Q3 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

Multifamily

Japan

STRONG DEMAND AND RENT GROWTH

- Driven by corporate hiring, wage growth, and increased office attendance – both domestic and foreign population growth in main city areas is rising, most of all notable in Tokyo’s 23 Wards.

- Propensity to rent has also increased as residential property prices continue to increase out of reach for more young people.

- Inner-city leasing conditions have strengthened compared to last year, with a renewed demand for units in areas with easy access to CBD locations – these units are typically smaller-sized, between 15 and 30 sqm and as a result have seen the strongest rent growth year-over-year.

- Rental growth is expected to move in line with wage growth, providing landlords a cushion against rising maintenance and financing costs. Rising utility costs also means that more energy efficient apartments would probably be well accepted by the renters.

- Investor interest in the sector and demand for portfolios have returned after being quiet for a while. Investment activity year-to-date in the multifamily sector has exceeded levels in 2023.

- Yield expansion in a rising rate environment in Japan would be inevitable. Yields are expected to stay stable in the near-term, with rental growth supporting increases in capital values. Beyond 2024, there could be mild expansion, more so in the regional cities.

MULTIFAMILY RENT INDEX 2023=100

Source: PMA, as of Q3 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

For more information, please contact:

HANNA SAFDAR

Head of Research and Strategy, Asia Pacific

hanna.safdar@aew.com

+65.6303.9014

JAY STRUZZIERY, CFA®

Head of Investor Relations

jay.struzziery@aew.com

+1.617.261.9326

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.