2025: A Positively Uncertain Start

PROGRESS IS VULNERABLE TO UNCERTAINTIES AND EXTERNAL SHOCKS

For real estate, 2025 is beginning on a somewhat positive note - property has repriced (or is still repricing), short-term interest rates have fallen from their 2023 peaks, and bid-ask spreads have narrowed, reflecting a pick-up in concluded property deals, especially in H2 2024.

However, positivity surrounding improved investment conditions is being tempered by policy uncertainty, particularly due to tariffs. In the weeks leading up to and following the U.S. presidential inauguration, financial markets and currencies have been volatile as participants attempt to price in the newer news.

PUBLIC REITS PROVIDE PRIVATE MARKET SIGNAL, LIQUIDITY IMPROVES

A recovery in the listed market is often seen as precursor of improvements to come in the private real estate market. In the Asia Pacific region, REIT performance was mixed in Q4, but in the first month of 2025, some positivity settled in Australia, especially in key growth sectors and on the back of expected interest rate cuts.

Looking at transaction volumes, momentum picked up in H2 2024 relative to 2023 and overall volumes transacted increased by 13% y-o-y to 192 billion1. These y-o-y increases were largely attributable to three markets – South Korea (+63% y-o-y), Japan (+10% y-o-y) and Australia (+24% y-o-y). We believe that these markets are likely to continue to lead volumes higher in 2025, as evidenced by deal flow pipeline, and select repriced opportunities.

NEW MINDSET FOR THE NEXT CYCLE

A few themes emerged in 2024 and are gathering momentum. Global sentiment for the office sector is shifting slowly from skepticism to optimism. Meanwhile, retail, which has been long overlooked by investors, now holds its brightest outlook in over a decade. Both cases prove that downturns don’t last forever.

For interest rates, 2024 highlighted how quickly policymakers’ decisions can ripple through debt markets, so having the ability to allocate across several markets with different rate paths – like Asia Pacific, helps to diversify this risk.

In previous cycles, property investment returns were largely driven by yield compression. In the coming cycle, with interest rates stabilizing at higher levels than the post-Great Financial Crisis period, yield compression will play a limited role, placing greater emphasis on solid fundamentals, disciplined acquisition strategies and value-add potential.

In that regard, Asia Pacific in this next cycle offers several advantages: 1) Diverse monetary policy and interest rate pathways; 2) Potential for new growth sectors in the broader living sector, healthcare and life sciences; 3) Continued market inefficiencies, creating opportunities for off-market acquisitions at competitive pricing.

FTSE EPRA NAREIT TOTAL RETURN (IN USD)

2015 TO 2024

ASIA PACIFIC TRANSACTION VOLUMES

2017 TO 2024

ASIA PACIFIC TRANSASCTION VOLUME BY SECTOR

IN USD

Source: Bloomberg, MSCI/RCA, as of Jan 2025

1 Note that transaction figures presented in this report excludes the USD16bn Blackstone-Airtrunk data center deal

Macro Picture on Shaky Ground

APAC AND EUROPE LEAD DOWNWARD GROWTH ADJUSTMENTS

The threat of a global trade war could have far reaching implications on financial markets, inflation and growth. Medium term global growth forecasts have been adjusted lower, with a weaker outlook in Europe and Asia Pacific, while the picture for the U.S. remains relatively healthy, given recent data on consumer spending, jobs growth and investment.

TRADE POLICY UNCERTAINIES, BUT APAC MAY HAVE SOME CUSHION

Predicting the eventual outcome of tariffs on U.S. imports is challenging given what we have seen in in the first few weeks of 2025. Targeted countries (Canada, Mexico & China) have responded with a mix of retaliatory measures and subsequently seeking compromises to protect their own interests.

In the Asia-Pacific region, many economies rely heavily on exports, but not all will face the same consequences regarding U.S. import tariffs. For instance, Australia and Singapore runs a trade deficit with the U.S., whereas economies like Japan and South Korea maintain substantial trade surpluses but are also key U.S. allies with significant foreign direct investment (FDI) in the U.S., which could provide them with leverage. Meanwhile, China is expected to unveil additional stimulus measures in March to mitigate the impact of U.S. tariffs, though concerns persist about its capacity to significantly boost domestic consumption and revive the housing market.

LIMITED GROWTH BRIGHT SPOTS BUT MORE POLICY EASING IN APAC

Near-term growth in the region nonetheless should be decidedly lower in 2025 vs last year. At this point in time, Japan appears to be a bright spot with a virtuous cycle in wage growth and inflation bolstering domestic consumption in the near-term.

The positive side of slower growth is that central banks are becoming more accommodative to support their economies. Australia implemented the first of three expected rate cuts for 2025 in February, while South Korea is likely to announce its third rate cut this cycle in Q1 2025. Meanwhile, the Monetary Authority of Singapore (MAS) eased its policy stance in January 2025. In contrast, Japan remains committed to its policy normalization efforts, although markets currently anticipate the policy rate to peak at just 0.8% in 2025.

JAPAN STANDS APART ON CURRENCY OUTLOOK

Most APAC currencies have declined for four consecutive years since 2021, now trading below their 10-year historical averages. While this suggests potential for a rebound due to mean reversion, the outlook remains uncertain. Interest rate differentials between Asia Pacific and the USD are likely to keep local currencies weak. However, central bank communication, trade policy, and market speculation will continue to drive volatility. Japan is expected to be an outlier, with the Yen likely to appreciate against the USD as the 10-year JGB yield rises.

GLOBAL GROWTH OUTLOOK

2017 TO 2026

POLICY RATES

2020 TO 2025

HISTORICAL CURRENCY MOVEMENTS AGAINST USD

2020 TO 2025

Source: Bloomberg

Cyclical Shifts and Structural Opportunities

Office

CYCLES START TO SHIFT, INVESTORS WARM UP THE SECTOR AGAIN, ALBEIT SELECTIVELY

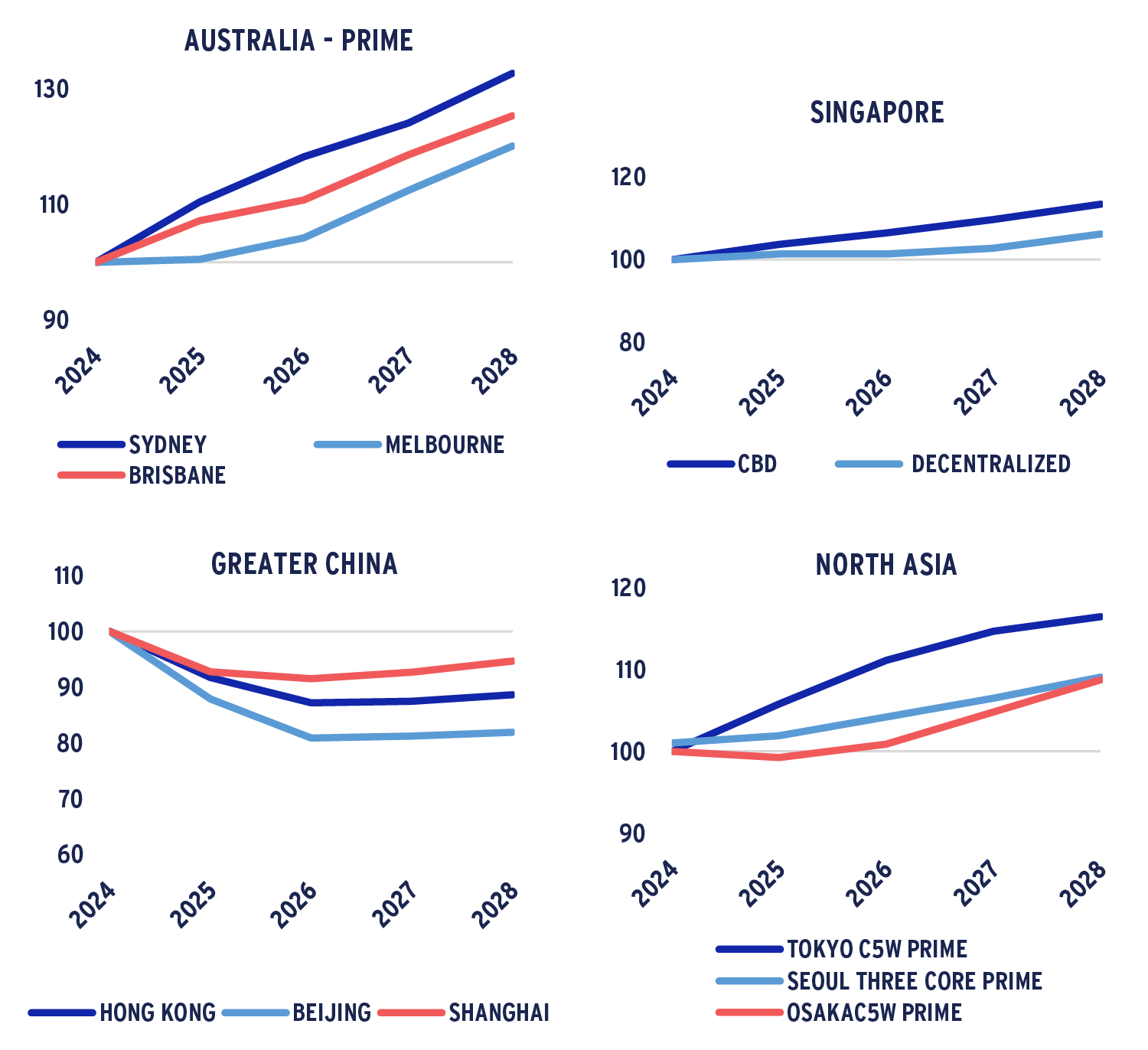

Market cycles are shifting, bringing renewed optimism to areas like Sydney’s CBD and the office markets in Tokyo and Osaka. With fundamentals increasingly favoring landlords in these geographies, the focus now is on understanding how long this cycle will last, especially with new supply on the horizon. In contrast, markets that saw strong rental growth in recent months, such as Seoul and Brisbane, are now experiencing a slowdown in momentum. Demand continues to be driven by centralization and a flight to quality, benefiting core locations like the CBD while temporarily disadvantaging peripheral areas. Some investors are revisiting their strategies for 2025, adding well-located prime-grade offices back into their portfolios, recognizing that the sector has repriced in certain markets and offers attractive entry points. However, selectivity remains critical.

Industrial & Related Alternatives

OCCUPIER DEMAND CONTINUES TO NORMALIZE BUT INVESTORS REMAIN KEEN

Logistics and industrial demand for full year 2024 came in slightly below initial expectations and about 25% lower than take-up recorded in the previous year 2023. As a result, there have been some mild downward revisions to the rental outlook- most markets now are expected to see rent growth move in line with inflation for the medium term. Submarket divergence should intensify in 2025, especially between urban/infill locations and high-supply submarkets. Demand uncertainty will be an issue going forward especially as tariffs weigh on global trade volumes. The silver lining is that new construction continues to be delayed/ cancelled, offsetting vacancy-driven weakness.

While oversupply continues to play out in the cold storage sector in South Korea, fundamentals are seemingly positive in other geographies for cold-storage, where existing properties are limited or not suited to modernized operations. Other adjacent sectors like self-storage have limited demand tailwinds in the ex-Australia markets.

Investor sentiment in the sector remains positive, although it has declined from 12 months prior. Investment volumes into the sector averaged USD34 billion in 2024 - making it the 2nd largest traded sector for the fifth year in a row.

Retail

SPENDING PATTERNS SHIFT ACROSS MARKETS

Retail sales and private consumption remain under pressure from still-high interest rates and a relatively weak economy. However, some relief is expected in 2025 as interest rates are forecast to gradually decline. During this period, discount stores perform well due to elevated inflation and pricing pressures, with consumers increasingly seeking low-cost goods and service. This is evident in Singapore, where residents head to Johor Bahru or Hong Kongers travel to Shenzhen for shopping. While the luxury segment faces challenges, Japan and South Korea are notable exceptions, supported by favorable exchange rates luring tourists in search of savings.

Despite operational challenges, the retail sector presents a compelling opportunity. Over the past decade, the sector has undergone significant rationalization, first from the rise of online sales and then during the pandemic. Retail stock per capita across major markets is now lower than in 2015, and upcoming supply is well below the 10-year average. This creates a favorable entry point, with forward-looking fundamentals appearing strong.

Living

OPPORTUNITIES IN THE LIVING SECTOR ARE BROADENING IN ASIA PACIFIC

The living sector in Asia Pacific is currently small but holds significant potential for growth. While urbanization and shifting lifestyles are well-known drivers, the core demand for rental housing today is centered on affordability challenges.

Demand spans a range of housing types, from short- and long-term serviced apartments to age-restricted options like student and senior housing, attracting investors eager to gain early entry into the sector. Japan’s multifamily market is well-established, whereas Australia’s build-to-rent (BTR) market faces some challenges, pushing investors toward alternative solutions such as co-living or serviced apartments. Increased activity is also emerging in Hong Kong, Singapore, and South Korea, particularly for co-living and student housing concepts. However, investors should note that housing-related sectors are often subject to policy risks.

Office

AUSTRALIA: SYDNEY CBD’S DOMINANCE RETURNS

Sydney CBD gains momentum, with rental forecasts revised upward substantially. Prime-grade assets in core areas are now expected to outperform - what was once a contrarian bet is now supported by market tailwinds.

In contrast, Melbourne CBD struggles with high vacancies and ongoing consolidation, drawing comparisons to the downturn of the 1990s. The previous recovery from this was driven by policy and zoning adjustments, which may once again be necessary for a turnaround.

SINGAPORE: LIMITED DEMAND DRIVERS

Take-up in Q4 2024 was the highest in the past two years, but was driven by move-ins at new buildings and increased concessions offered by landlords. While a strong rent cycle over the next five years appears unlikely, potential building withdrawals under the government’s 2025 urban planning review could provide some support.

A safe haven market with limited repricing, institutional buyers sat out on major office purchases in 2024, instead most buyers were HNIs or family offices.

HONG KONG: MORE WEAKNESS IN RENTS AND SALES

A relatively active IPO market in 2025 (about 70 to 80 expected listings) is unlikely to reignite demand as tariff and trade uncertainty leads to continued weakness. Rents are expected to continue their downward trend in 2025 (already down 45% from the 2019 peak), as vacancy stays above 13%.

Over 60% of office sales in 2024 were at a capital loss, a trend likely to continue in 2025 with interest rates expected to remain high

CHINA: PROTRACTED WEAKNESS IN LEASING AND SALES

Expanding vacancy and tenants being cost-conscious have made large rent reductions and incentives commonplace. Effective rent levels are around half of their 2019 peak. The outlook remains challenging, with 24 million square feet of new supply expected over 2025/6, ~5% more than the previous two years.

Assets are being offered at significant discounts, but buyer interest remains low. As China’s downturn enters its fifth year, operational challenges and rising negative equity are likely to lead to more distressed sales or defaults.

SOUTH KOREA: SOME TENANTS SEEK MORE AFFORDABLE OPTIONS

While rent reversions are highly lucrative today, 20 to 25% on average, affordability pressures have also increased. South Korea’s office market marked its first quarter of negative net absorption in Q4 as some tenants gave up pricey rents for cheaper options in fringe markets.

Pricing remains elevated, with several deals completed between July and September supporting this trend. Discount or distressed sale opportunities from sellers facing liquidity or financing constraints are rare but do present themselves occasionally.

JAPAN: RENT OUTLOOK UPGRADED AGAIN, BOTH TOKYO AND OSAKA

The underlying health of the Japanese economy is reflected in the broadening demand playing out in both Tokyo and Osaka. While flight to quality and upgrading is a consistent theme, its benefit is being realized across the various grade stratum of the office market from Prime, Grade A and Grade B. Despite the large supply forecast for 2025 and 2026, rental growth could extend through this period.

OFFICE RENT INDEX 2024=100

Source: AEW Research, JLL, Q4 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

Logistics

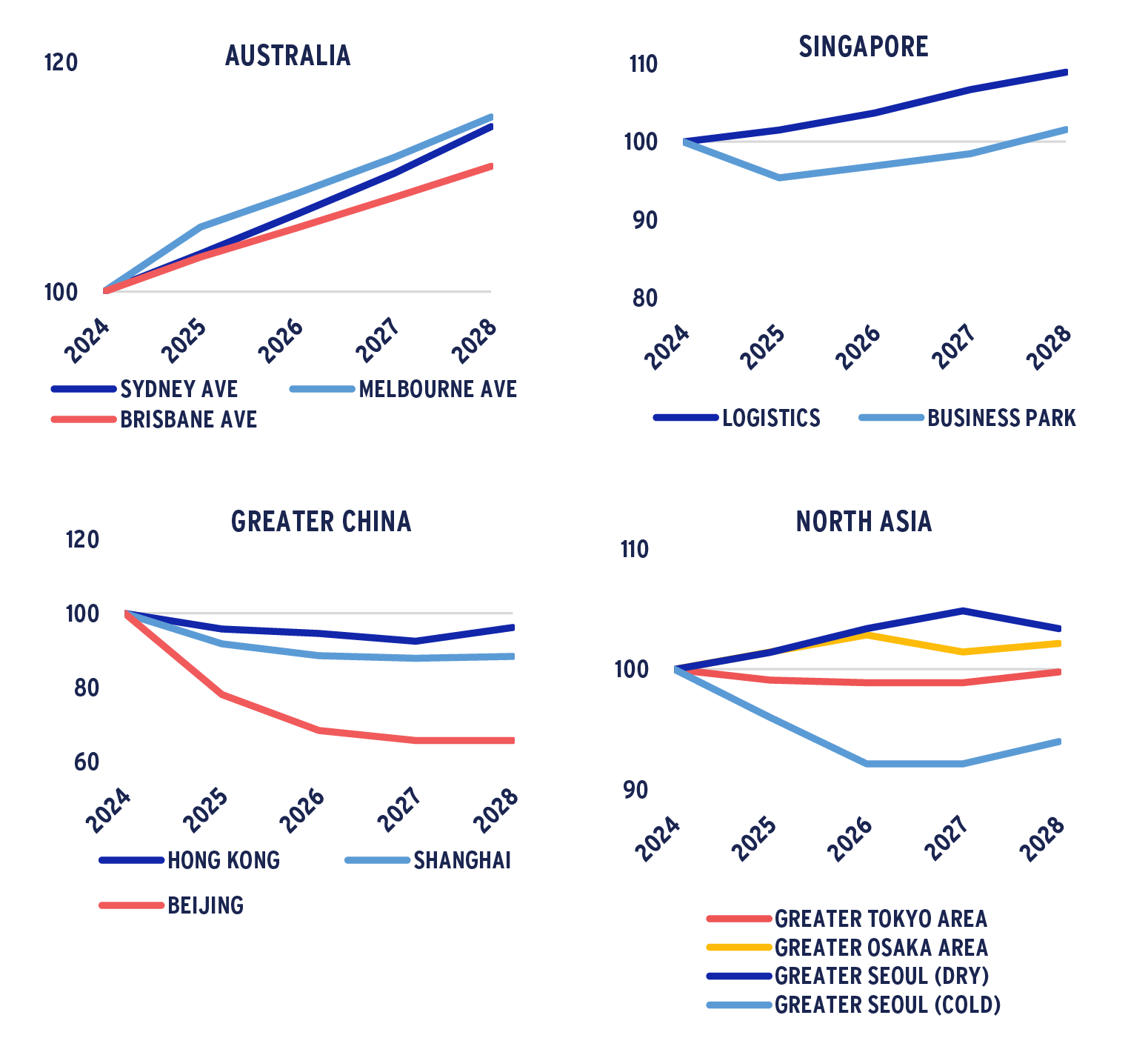

AUSTRALIA: DEMAND SLOWS, INVESTORS KEEN ON LAND BANKING SUPPORT YIELDS

Australia's industrial sector has the lowest vacancy rates globally, reflecting strong fundamentals. However, high levels of speculative supply—exceeding the 10-year average—and cooling demand are impacting the market. This is particularly evident in Western submarkets in both Sydney and Melbourne, where new supply is concentrated. Pre-commitment rates for projects under construction have dropped to 50%, and incentives for new leases have risen to 30% in some cases.

Still the sector remains highly attractive to both domestic and cross-border investors. More competition for land acquisition is driving up land values once more, which could lead to mid-yield compression starting in the second half of 2025.

SINGAPORE: LITTLE NEAR-TERM BENEFITS FROM NEW ECONOMIC ZONE

Industrial sector conditions are slightly more favorable than Singapore’s office sector and are expected to maintain landlord-friendly conditions. The new Special Economic Zone (SEZ) between Singapore and Johor will boost occupier demand, but ownership restrictions and occupier subsidies will likely limit benefits for landlords in the near-term.

Meanwhile, business parks and high-tech spaces face tougher occupier conditions as downsizing, rightsizing, and centralization are driving up vacancy rates.

HONG KONG: DEMAND HEADWINDS INCREASE, LIQUIDITY RESTRICTED

Leasing activity may have temporarily increased in Q4 2024, but trade policy from the new U.S. administration brings a whole new set of risks to warehousing and storage demand. In early February we saw the US postal services implement a ban on low-cost packages from Hong Kong and China (which was later repealed, but subsequently followed by a 10% levy).

Liquidity is expected to be limited in the face of uncertainty, policy headwinds and interest rates remaining high.

SOUTH KOREA: BETTER OUTLOOK FOR DRY STORAGE VS 12M AGO

New construction has moved past its peak and oversupply concerns are less today than they were 12 months ago, improving the rental outlook slightly. Leasing momentum remains active (although some slight destabilization from the political chaos in Q4). Challenges in cold storage remain with vacancy ranging from 30 to 40%.

Investment activity has picked up with discounted opportunities generally at below replacement cost. Investors are selective, focusing on location, asset type and terms to minimize leasing risk.

JAPAN: PERFORMANCE WILL BE LOCATION SPECIFIC, INVESTMENT ACTIVITY MODERATING

Investors are becoming more cautious about the sector amid concerns over rising vacancy. However, we see positive demand tailwinds, although rental trends are increasingly dependent on local supply conditions. For instance, western inland markets in Tokyo are weak, while Tokyo Bay and city periphery areas (Route-16 and Gaikando) are performing better.

Regional cities like Osaka and Fukuoka also show more landlord-friendly dynamics and offer a solid yield premium over Tokyo. Nonetheless, investment activity in the industrial and logistics market is slowing, with sellers currently outnumbering buyers.

OFFICE RENT INDEX 2024=100

Source: AEW Research, JLL, Q4 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

Retail

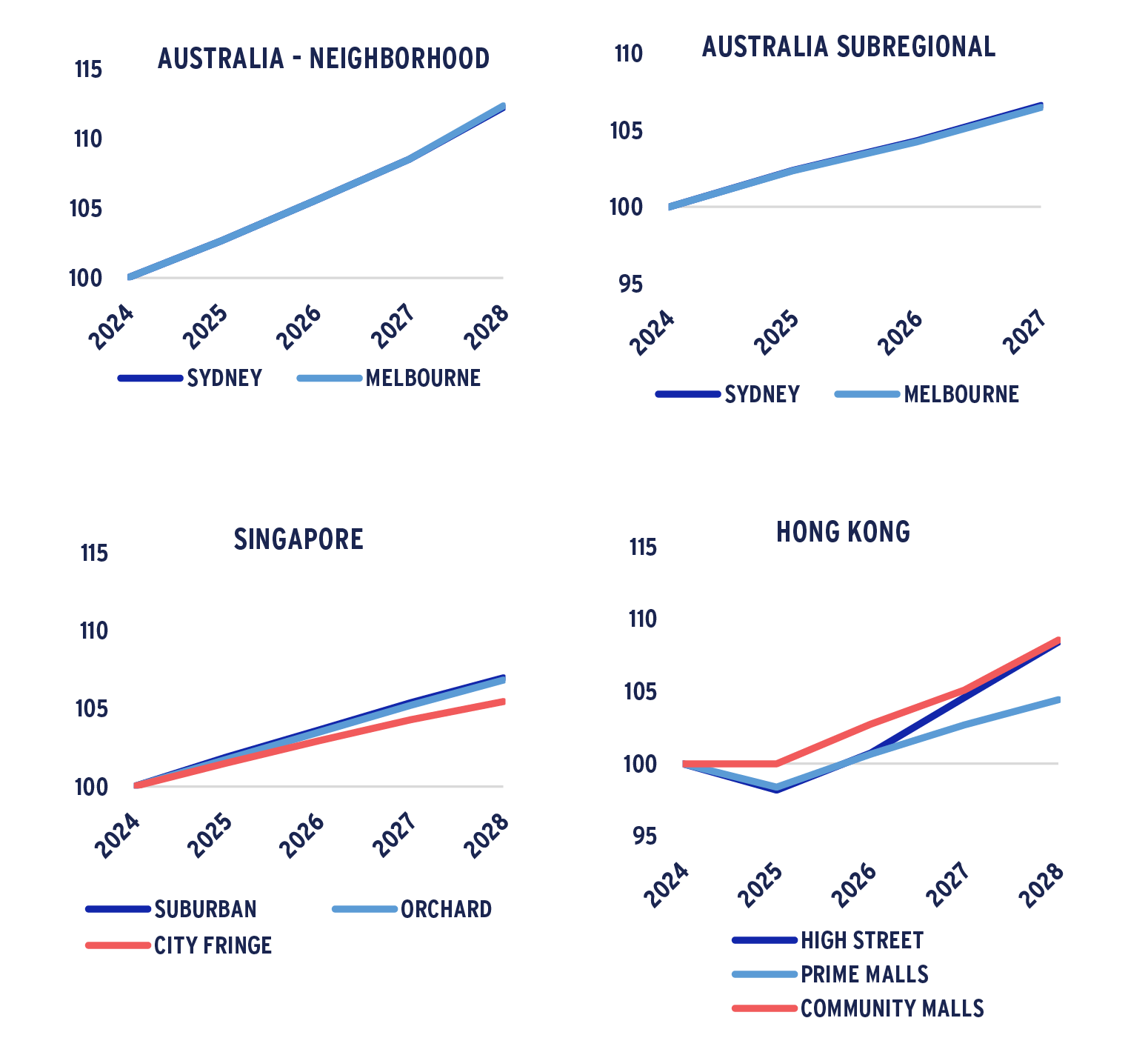

AUSTRALIA: RATE CUTS COULD BOOST CONSUMER SPENDING

The sector has a relatively positive outlook, mirroring some of the conditions observed in the U.S. and Europe. The sector has repriced, offering an attractive entry point. Overall retail stock has reduced since 2015 and new supply is a fraction of what it used to be. Crucially, Australia’s population continues to grow, aided by relatively robust net migration flows. Overall supply in the sector is about 70% below the 10-year historical average. Within this, neighborhood retail has the highest volume of new construction, but this is not a concern as these locations are well-supported by residential demand.

Recognizing this confluence of favorable market conditions, it is unsurprising that 2024 investment volumes are nearly 40% higher than the previous year. With more activity in 2024, retail yields are already compressing in some asset types and locations, indicating that any available windows of opportunity may be relatively short.

SINGAPORE: SUBURBAN RESILIENCE BUT RISING CHALLENGES

Retail sales have declined recently, mainly due to weaker tourism-related demand. Although tourist arrivals are stable, spending patterns have shifted, with less interest in shopping and more focus on experiential retail. Instead, suburban retail remains resilient. Major REITs reported footfall growth of 3-8% y-o-y and positive rental growth, even in northern located malls that were expected to face competition from cross-border shopping (to Johor Bahru), where prices are about 50% lower. However, high business closure rates in both retail and F&B highlight the sector’s competitiveness and ongoing challenges with labor and rental costs.

In Singapore, transaction volumes are at a three-year low, with several large assets remaining unsold for months.

HONG KONG: LIKELY TO SEE FURTHER DOWNTURN

December retail sales declined by 9.7% year-on-year, signaling there may be further challenges ahead for 2025. Hong Kong's retail sales have declined for 10 consecutive months as more residents shop and seek entertainment in Shenzhen. Meanwhile, Mainland Chinese tourists have not returned in previous numbers despite renewed travel.

Although H2 2024 saw new retailer demand and some international fashion brands expand, rents are down, and major landlords continue to support tenants facing rising operational costs and labor shortages.

Government initiatives aimed at boosting tourism, market sentiment, and employment income offer some hope, but most economists still expect retail sales to decline in 2025, likely leading to more store closures and vacancies.

Transaction activity remains subdued, with mostly strata sales and some enbloc deals, but at significant discounts.

RETAIL RENT INDEX 2024 =100

Source: JLL, as of Q4 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

Living

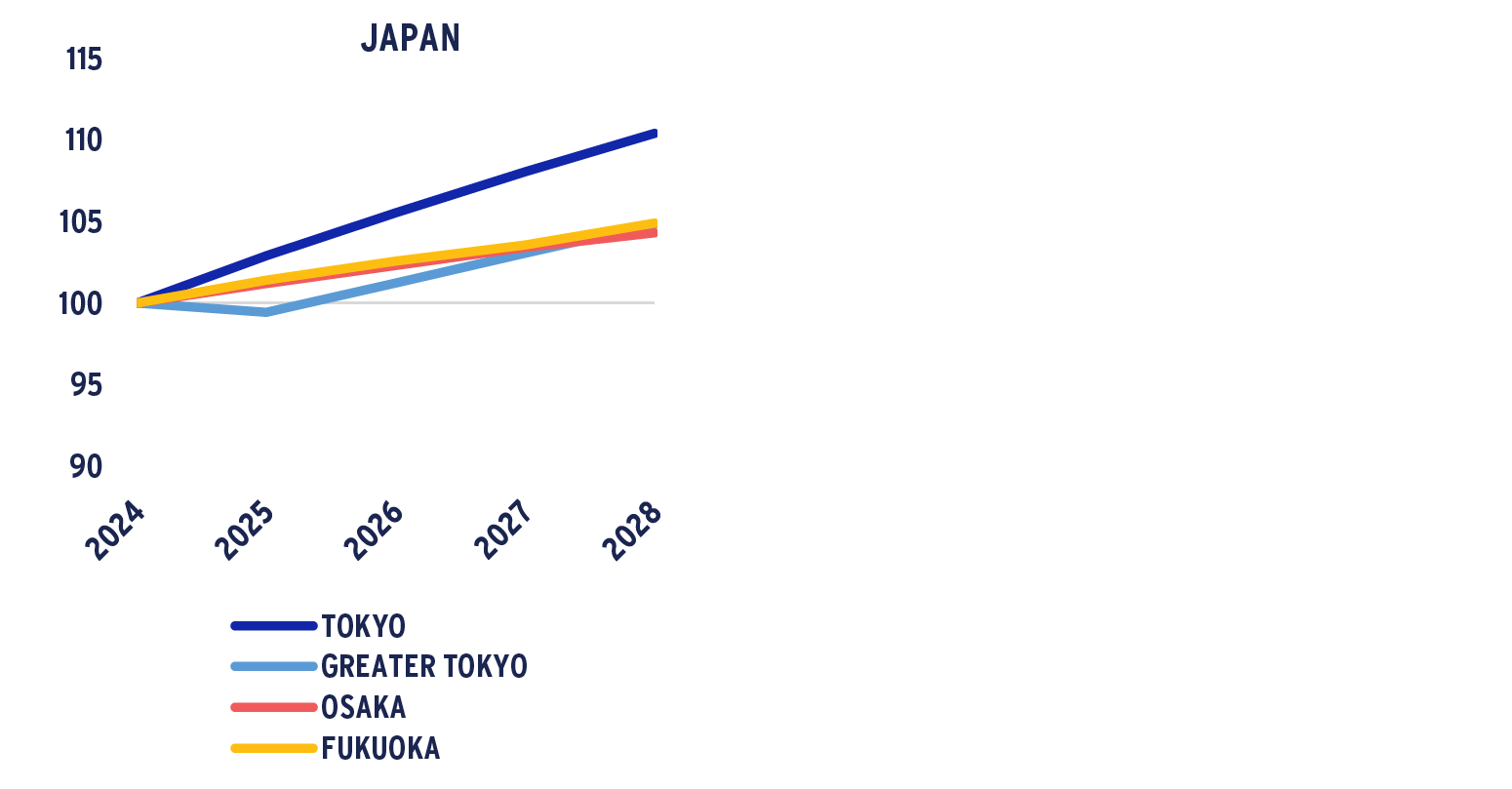

JAPAN: STRONG DEMAND AND RENT GROWTH

Japan’s multifamily market is benefiting from strong demand, limited supply, and a positive cycle between inflation and wage growth, allowing landlords to pass on higher costs to tenants. Meanwhile, purchasing affordability remains a challenge, with resale condominium prices rising 50-60% since 2019. Rising interest rates are further pricing many out of homeownership, forcing them into the rental market.

In 2024, rental growth became more widespread, with rents increasing 6 to 7% across Tokyo’s 23 Wards, affecting both new leases and renewals. The growing number of foreign renters is also driving demand, with serviced residences and co-living spaces—largely catering to expatriates—gaining popularity.

Investor interest in Japan’s multifamily sector is strong, with 2024 investment activity surpassing 2023 levels. Despite rising interest rates, yields should remain stable in the near-term, supported by rental growth that will likely drive capital values higher. Beyond 2025, modest yield expansion is anticipated, particularly in regional cities.

JAPAN: STRONG DEMAND AND RENT GROWTH

Source: AEW Research, as of Q4 2024

There can be no assurances that any prediction, projection, or forecast will be realized.

For more information, please contact:

HANNA SAFDAR

Head of Research and Strategy, Asia Pacific

hanna.safdar@aew.com

+65.6303.9014

JAY STRUZZIERY, CFA®

Head of Investor Relations

jay.struzziery@aew.com

+1.617.261.9326

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.