EUROPEAN RESIDENTIAL RETURNS TO FOCUS ON CURRENT INCOME AND RENTAL GROWTH

- Despite lower mortgage rates and a recovery in lending volumes over the last year, affordability for homeowners is projected to remain challenging as 2025-29 house prices are forecast to increase by 3.5% p.a. in both the Eurozone and the UK.

- New supply of housing remains limited and continues to fall short of most government targets. In addition, the private-rented stock is decreasing as a result of regulations making buy-to-let investments less attractive in the UK, Netherlands and France.

- European prime residential market rents are projected to see 3.2% p.a. growth in 2025-29, ahead of inflation, despite most governments having tightened rental regulations over the past couple of years.

- Despite a 25% increase from 2023, residential investment activity remained weak in 2024 with European volumes totaling just under €40 bn. With improving financing conditions, liquidity is returning to the market, leading to some yield tightening.

- Due to the strong supply-demand dynamics and stable cash flows, investors’ appetite for residential remains strong. Since 2008, residential has doubled its share in total investment volumes to 21% in 2024.

- Based on our latest forecasts, prime residential yields will tighten from 2025 by an average of 30bps by 2029, partly reversing the 130bps yield widening since mid-2022.

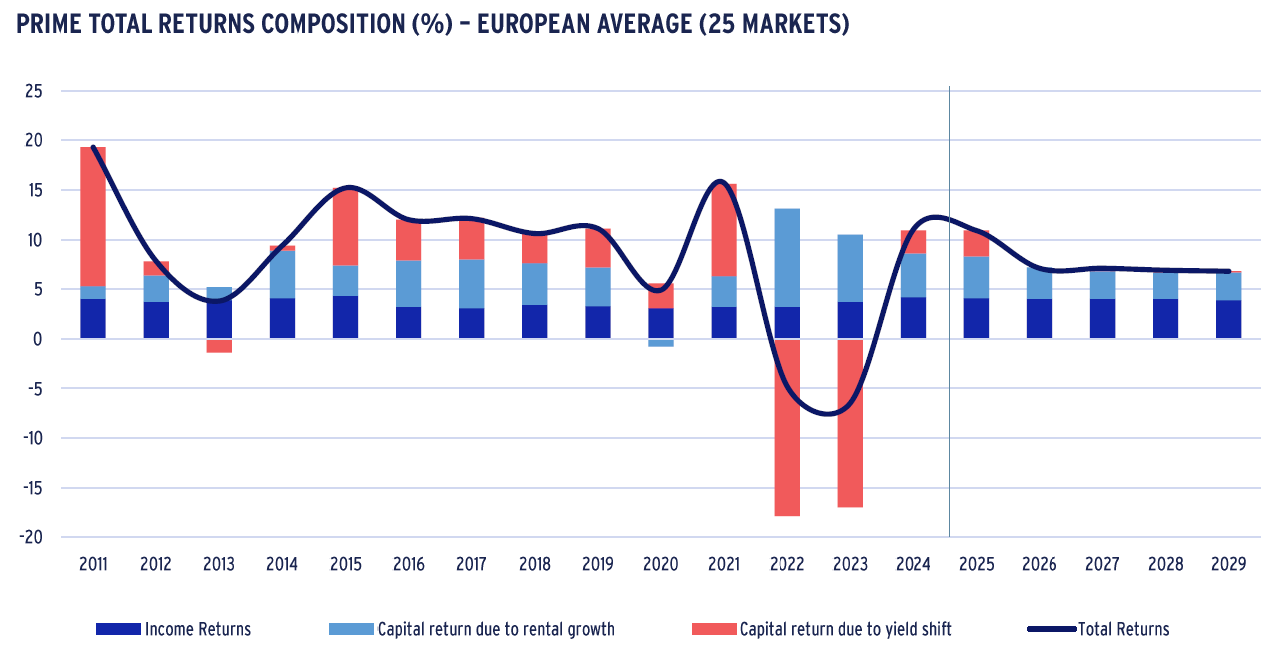

- As shown below, 2025-29 European residential total returns are expected at 7.7% p.a. driven mostly by current income (4.0% p.a.) and capital return from rental growth (3.1% p.a.), with limited capital return coming from yield compression (0.6% p.a.).

- Finally, our analysis of the UK single family market confirms that this sub-sector benefits from strong fundamentals as home ownership remains inaccessible for many households. This is confirmed by the rise in investments in the sector.

Source: CBRE, AEW Research & Strategy as of March 2025

FALLING MORTGATE RATES ARE DRIVING THE RECOVERY IN HOUSE PRICE GROWTH

MODERATING MORTGAGE RATES

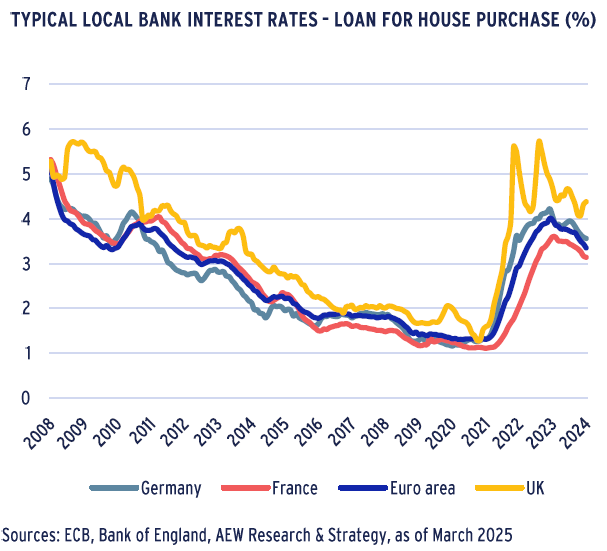

- As central banks have been cutting their base rates, the average Eurozone mortgage rate steadily declined to 3.35% by year-end 2024, a 62 bps decline from 2023.

- This partially reverses the significant increase in mortgage rates from 1.32% recorded since the year-end 2021 after the ECB and BoE started hiking their base rates to curb inflation.

- At 4.40% UK 5-year fixed rate 75% LTV mortgage rates are more than 100 bps higher than in the Eurozone after coming down from their 5.7% peak. This is due in part to higher UK inflation and the Bank of England’s policy

- Lending criteria remain strict in the UK, with large down payments requirements (typically 15-20% for first-time buyers).

- UK mortgages are also dominated by variable or short (2-5 years) fixed mortgages rates in contrast to typically fixed rates for 20-25 years in the Eurozone.

- High rates leave many households unable to afford a loan for a home purchase. At the same time, this supports the demand for rental units in the private rented sector and institutionally managed BTR.

MODEST RECOVERY IN BANK LENDING PUSHED HOUSE PRICES UP

- In addition to the rise in interest rates, there has been a sharp decline in lending from banks to finance house purchases, after eight years of steady increase, uninterrupted by the Covid pandemic.

- House price growth and residential mortgage lending volumes have historically been highly correlated.

- The decrease in lending activity has caused house price growth to slow down sharply from 10% in Q1 2022 to -2% in Q3 2023, a modest decline.

- As banks started lending again at the end of 2023 and into 2024, house price growth has turned positive in Q2 2024 and accelerated to almost 4% y/y in Q4 2024.

- This rebound in lending and house prices is expected to continue in 2025 as mortgage rates are expected to come down further alongside central banks’ rates.

2025 HOUSE PRICE RECOVERY PROJECTED TO GAIN MOMENTUM

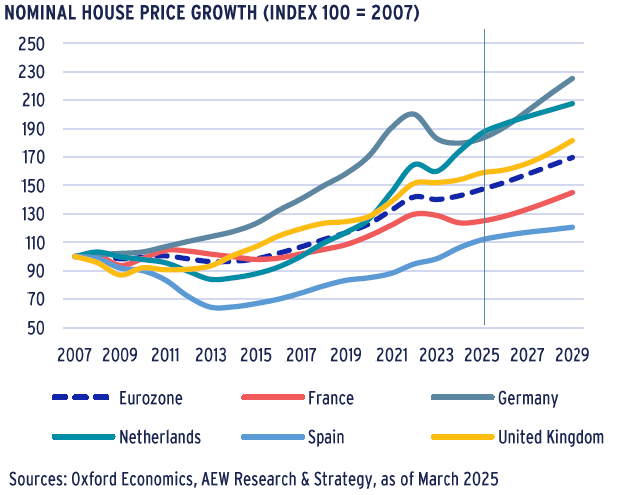

- House prices started recovering in 2024 across Europe, with Germany and France lagging most.

- Since the rise of interest rates, European markets experienced a modest decline in prices, ranging from -8% in Germany, -3% in the Netherlands to -1% in France. House prices remained stable in the UK.

- Spain’s larger GFC impact and slower recovery makes it stand out as an exception in Europe as its house prices have continued to increase by around 6% per annum on average between 2002 and 2024.

- Going forward, Oxford Economics projects an increase of 3.5% per annum on average in the Eurozone over the next five years (3.4% in the UK). This represents an upward revision compared to the 2.4% forecast from last year.

CONSTRUCTION ACTIVITY HAS NOT RECOVERED, PUTTING INCREASING PRESSURES ON THE RENTAL MARKET

NEW SUPPLY FALLING SHORT OF GOVERNMENT TARGETS

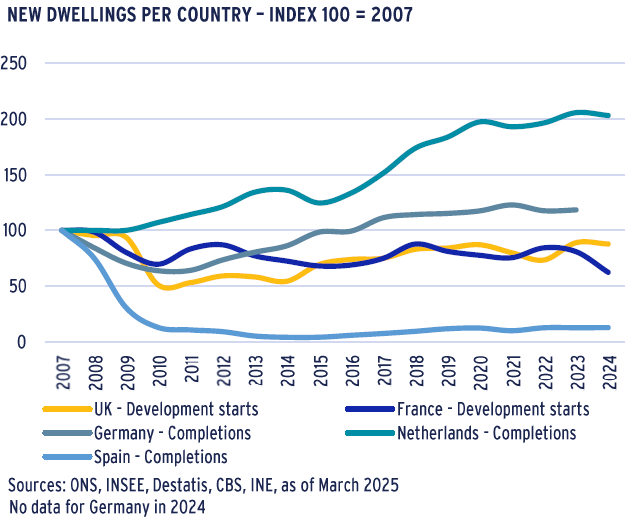

- As the chart shows new supply of housing has been limited in Europe over the past two decades.

- Spain has not recovered from the collapse in construction activity since the pre-GFC boom.

- Despite a recent decline, at 380,000 p.a. France has built more dwellings since 2007 than any other European country, including Germany (243,000) and the UK (174,000).

- Completions have been increasing since 2007 in Germany and the Netherlands but remain short of the annual targets.

- 2025 German completions are expected to be as low as 230,000 units compared to a government target of 400,000.

- The Netherlands delivered 69,000 dwellings in 2024 compared to its target of 100,000.

- Available privately-rented units have decreased in many markets due to fiscal changes making buy-to-let less attractive to private investors and as a result of an increasing number of dwellings being let short-term on platforms such as Airbnb or sold.

TIGTEHNING RENTAL REGULATIONS ACROSS EUROPE

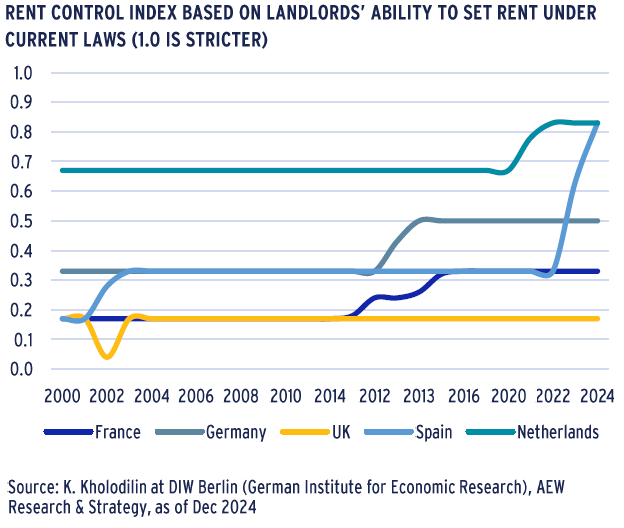

- Regulations of the private rented sector vary across Europe. To compare these regulations we refer to an index developed by DIW Berlin.

- Based on this, the UK appears to be the most landlord-friendly market. However, the Renters’ Reform Bill, expected to pass into law in summer 2025, intends to give tenants greater protections.

- Conversely, the Netherlands and Denmark are the most tenant-friendly markets.

- As a result of the increasing housing supply shortage, many countries have recently tightened their rental regulations.

- The Spanish national government implemented new limits to rental growth. In addition, the Catalonian regional government has implemented its own rent controls.

- In the Netherlands, the July 2024 Affordable Rent Act includes a larger number of units in the regulated sector. However, as this is not impacting the rental regulations themselves, the index score has not changed.

RENTS PROJECTED TO INCREASE AT SLOWER PACE

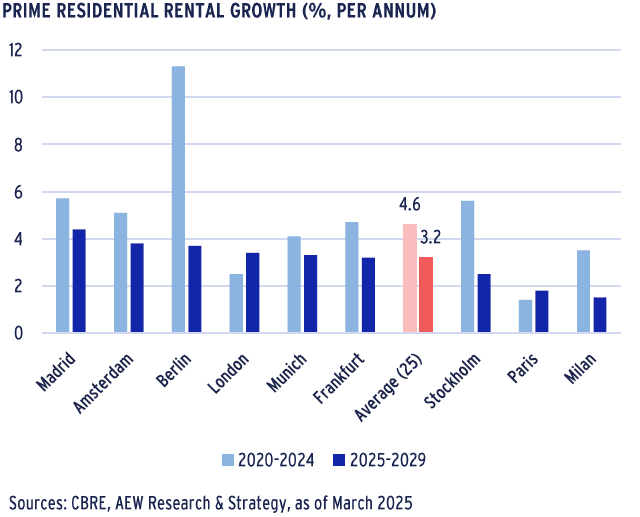

- Prime residential rental growth of 4.7% in 2024 in Europe was in line with the 2020-24 average of 4.6% p.a., which confirms Europe’s long-term supply shortages described earlier.

- Based on our latest projections, we expect 3.2% p.a. prime residential rental growth across the 25 European markets for 2025-29, above the 2.0% p.a. projected inflation.

- Along the largest European markets, Madrid, Amsterdam, Berlin and London are expecting to outperform the European average over the next five years.

- Most rental regulations across Europe do not apply to newly-built dwellings, where prime rents tend to be achieved.

- Regulated and non-regulated rental markets serve different tenant bases, mostly based on affordability.

INVESTMENT ACTIVITY RECOVERED, PRIME RESIDENTIAL YIELDS STARTED COMPRESSING

2024 ACTIVITY PICK-UP EXPECTED TO ACCELERATE IN 2025

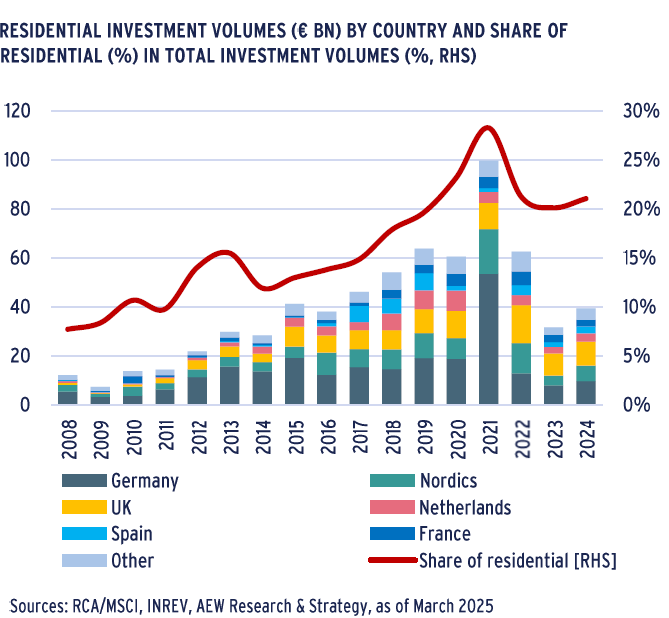

- European residential volumes totaled just under €40 bn in 2024, a 25% increase compared to 2023. However, this is still down 25% compared to its 10-year average.

- The 2024 pick-up in investment activity has mostly been driven by the Nordics, Spain and the Netherlands.

- The number of residential transactions recorded has started increasing reflecting investor appetite for the sector.

- In both the INREV and the CBRE 2025 Investment Intentions Surveys, residential took the first position as preferred sector, ahead of logistics.

- This investor preference can be explained by the strong fundamentals providing stability of cashflows offered and attractive financing conditions.

- On the back of these preferences, it is expected that 2025 volumes are likely to be boosted by large residential portfolios, notably in France and the UK.

SHARE OF RESIDENTIAL HAS INCREASED ACROSS EUROPE

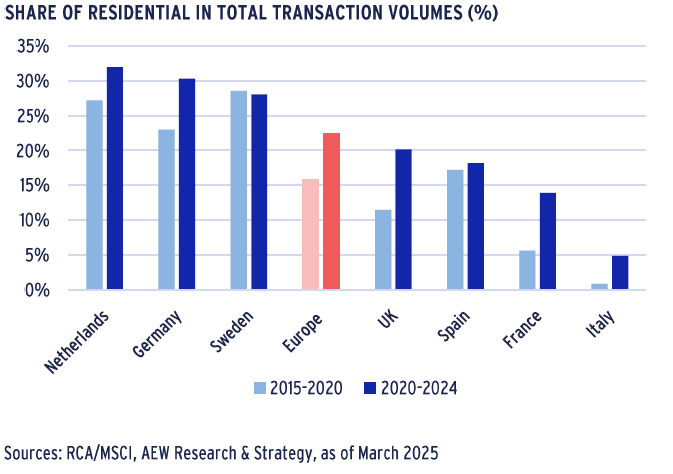

- Over the last 15 years, residential has doubled its market share of total volumes invested in European property from 8% in 2008 to 21% in 2024.

- Residential represents around 30% of total volumes invested in property in the Netherlands, Germany and Sweden, compared to around 20% in the UK and Spain, 14% in France and only 5% in Italy.

- The share of residential in total investment volumes increased in all countries except Sweden. The largest increases were recorded in the countries where the share of residential is the lowest - Italy, France and in the UK.

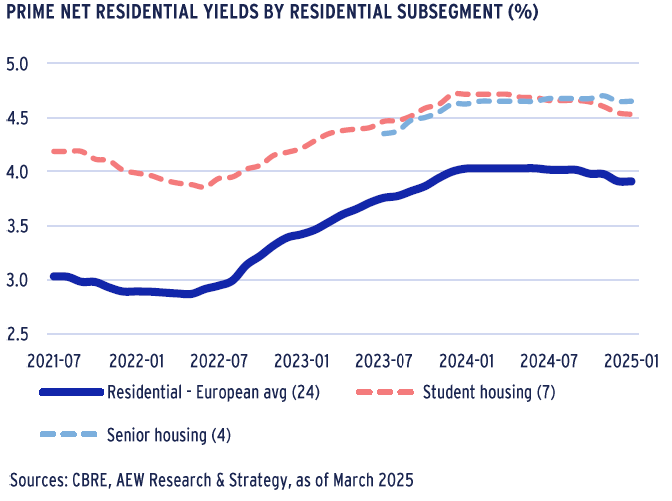

PRIME RESIDENTIAL YIELDS STARTED COMPRESSING AGAIN

- From the second half of 2024, prime European residential yields started compressing again, moving in by 10 bps from a peak of 4.1%.

- It seems that all prime European residential markets have now fully repriced.

- Prime student housing yields also compressed from 4.7% on average across seven European markets, to 4.5% at the start of 2025.

- By contrast, prime senior housing yields have remained at 4.7% on average across the four European markets covered.

- The lack of senior housing transactions over the past couple of years can be explained by concerns around the profitability of a number of senior housing operators. Consolidation between operators is set to continue.

LIMITED YIELD COMPRESSION GOING FORWARD, RETURNS WILL BE DRIVEN BY RENTAL GROWTH

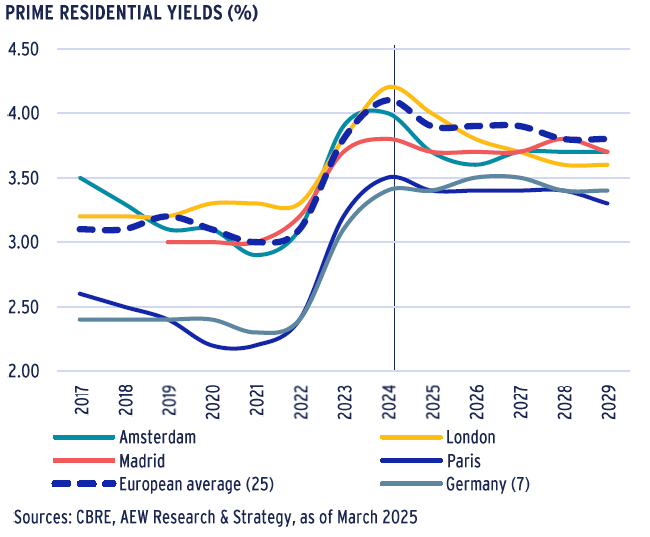

PRIME RESIDENTIAL YIELDS EXPECTED TO COMPRESS BY 30 BPS

- Our Mar-25 forecasts indicate that prime residential yields will compress from their 4.1% peak in 2024 by 30bps to reach 3.8% in 2029.

- This projected tightening is a partial reversal of the 130bps yield decompression recorded in 2022 and 2023.

- These yield forecasts reflect Oxford Economics’ projected stabilisation of government bond yields as central banks are expected to further cut their base rates in 2025.

- The strongest yield compression is expected in London, where prime residential yields are forecast to decrease from 4.2% to 3.6%.

- However, modest yield compressions are also expected in other European capitals, including Paris, Amsterdam and Madrid as well as the major German markets.

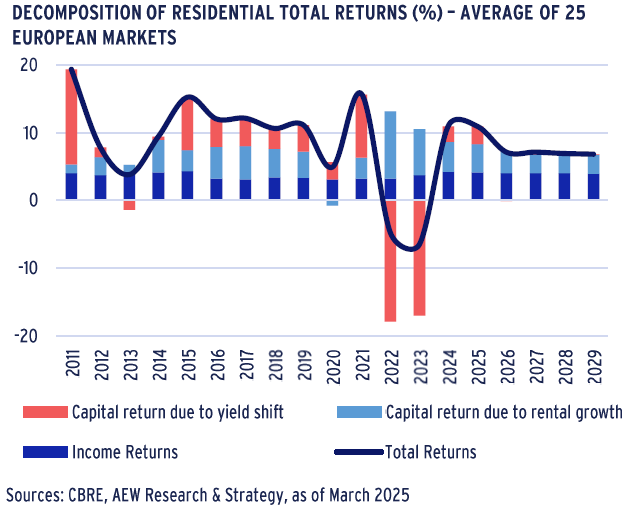

PROJECTED RETURNS DRIVEN BY CURRENT INCOME & RENT GROWTH

- As the chart shows, 2025-29 European residential total returns are expected at 7.7% p.a. driven mostly by current income (4.0% p.a.).

- Going forward, capital return from rental growth is projected at 3.1% p.a. over the next five years, slightly lower than the long-term average (3.9% pa).

- In contrast, the forecasted capital return from future yield shift is projected to be modest at 0.6% p.a. and concentrated in 2025.

- The projected capital growth from yield tightening of 0.6% p.a. over the 2025-29 period, reflects a significant improvement from 2022 and 2023.

- In these two years, yield widening triggered large negative capital returns of -18% and -17% p.a. with existing income and rental growth tempering its impact on total returns.

LONDON EXPECTED TO OUTPERFORM THE EUROPEAN AVERAGE

- Our Mar-25 forecasts show significant variations across the 25-market average of 7.7% p.a. total prime return for the next five years.

- Since some yield compression has already been recorded in 2024, our returns are slightly weaker than our previous 8.3% p.a. forecasts for the 2024-2028 period.

- All residential markets should benefit from prime total returns exceeding 6% per annum over the coming 5-year period, assuming an investment in 2025.

- London, Amsterdam and Madrid are expected to outperform the European average with 10.9%, 8.6% and 8.1% p.a. returns respectively.

- These are mostly driven by stronger yield compression.

- By contrast, prime Berlin and Paris residential are expected to underperform with 6.5% and 5.9%, respectively.

SPECIAL FOCUS: UK SINGLE FAMILY RENTAL

UK HOUSEHOLDS RENTING FOR LONGER AS BUYING IS OUT OF REACH

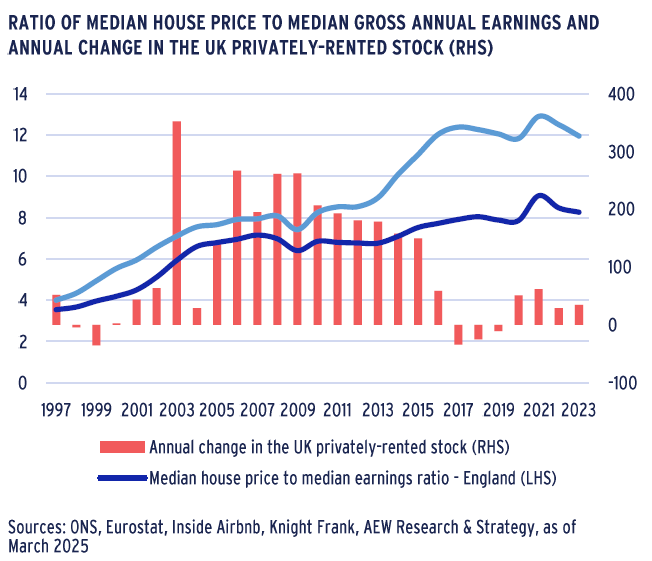

- Affordability remains a key concern with full-time UK employees needing to spend more than 8 times their annual earnings to buy the average home (12 times in London), up from 6 and 7 in 2009.

- This can be partly explained by the acute housing shortage and shortfall in housing delivery.

- Despite increasing demand pressures the stock of private rented units actually fell in 2017-19. as shown in the chart.

- 2024 listings data shows that the number of houses available to rent has dropped 41% compared with the 2017-19 average.

- This is due to policies making buy-to-let less financially attractive for private investors (who own 94% of privately-rented stock).

- These include the gradual removal of the mortgage tax relief since 2017 and higher stamp duty for second home owners since 2016.

- The increasing number of short-let rentals on platforms such as Airbnb is also taking units away from the long-term rental market.

- The number of listings on Airbnb alone represent up to 7% of total dwelling stock in central London.

UK SINGLE FAMILY HOME DEVELOPMENTS ARE INCREASING

- Single Family Homes (SFH) are a sub-sector of Built to Rent (BTR), which includes private rental homes that are institutionally owned and professionally managed.

- SFH consist of houses as opposed to Multifamily BTR schemes consisting of blocks of flats with communal services. SFH typically attract working couples and families.

- With 80% of the UK housing stock consisting of houses as opposed to flats, SFH are offering an alternative to households willing to live in a house yet unable to afford to buy it.

- At 11% of BTR, SFH is currently a small subsector of BTR.

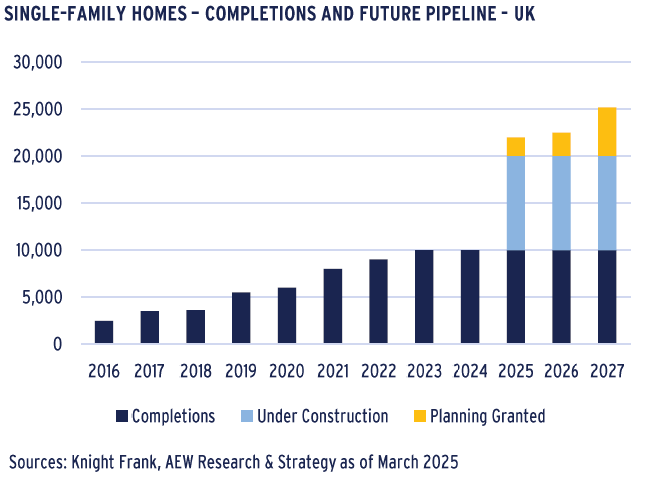

- However, the number of SFH units in the UK is increasing fast, with 12,000 operational units and a further 15,000 in the pipeline (under construction or with full planning).

- SFH development is adding more energy-efficient dwellings to an aging existing stock (>70% of PRS was built before 1980) with 25% of PRS falling below the government’s ‘Decent Homes Standards’.

INVESTMENT IN SFH ON THE RISE

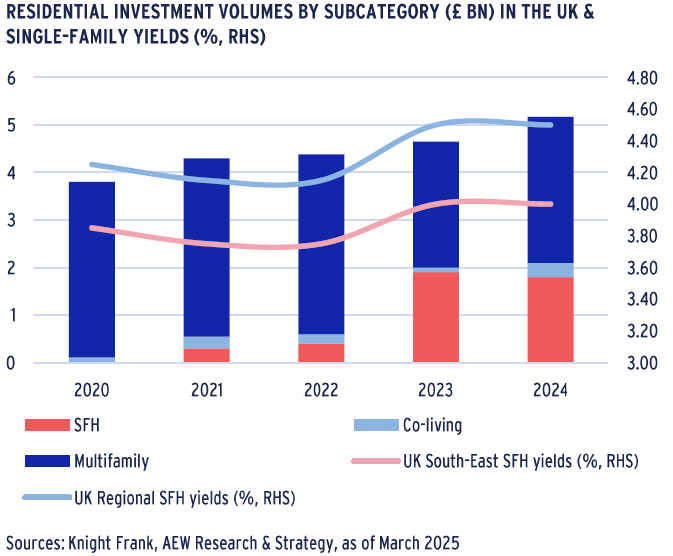

- Reflecting the increasing maturity of the sector, the volumes invested in UK SFH has increased significantly to £1.9 bn in 2023 and £1.8 bn in 2024, from £400 million in 2022.

- The subsector represents an increasing share of the UK residential investment market (from 6% in 2020-22 to 40% in 2024).

- 2025 volumes will be boosted by large equity commitments of various national and international investors (CPP IB, Korea’s National Pension Service, UBS, GCM Grosvenor, Aberdeen etc) in vehicles dedicated to the strategy.

- SFH yields currently stand between 4.00% in the South East and 4.50% in the UK regions.

- Compared to BTR, SFH benefits from lower tenant turnover, a lower median spend on rent (25% of gross income vs 33% in the PRS sector) and lower operating costs and capital expenditures.

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.