LOGISTICS REMAINS FAVORITE AS TAKE-UP AND VALUES ARE PROJECTED TO RECOVER

- The European macroeconomic outlook has improved in H1 2024 as both retail sales and industrial output rebounded. Together with normalizing global supply chains and continued growth in e-commerce sales penetration, logistics take-up is projected to recover from its recent slowdown.

- Given solid corporate revenue growth from 3PLs, retailers and e-commerce platforms, affordability of rent to revenue has improved for most logistic occupiers, even if rents are only a small share of the overall costs.

- Logistics take-up did slowdown in 2023 and Q1 2024 from record high levels during the 2021-22 Covid period. Vacancy rates increased but remained at 4% across our European universe and are expected to come back in.

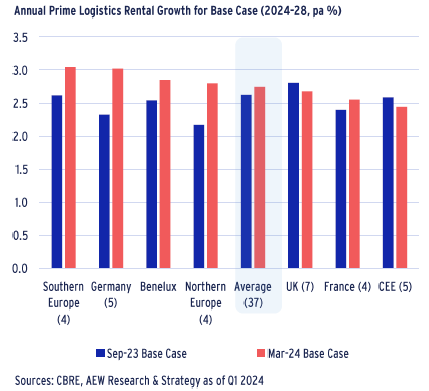

- As a result, our projected 2024-28 annual rental growth for logistics markets improved to 2.7% p.a. compared to Sep-23. Southern Europe and German markets are forecast to show the highest rental growth, both at 3% p.a..

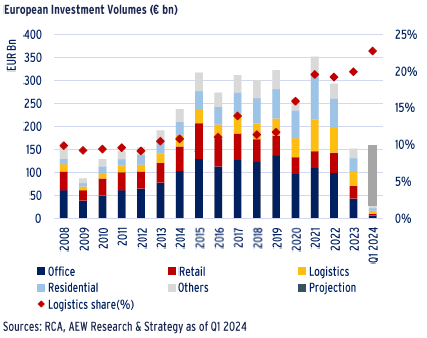

- In line with most other European property sectors, 2023 logistics deal volumes halved as interest rates remained high and bid-ask spreads persisted. However, we project a revival for logistics deal volumes and capital values after a 19% cumulative decline in the last two years – as shown below.

- European logistics transaction prices have already stabilized and are expected to rebound quickest of any sector. Unsurprisingly, investors’ sentiment for logistics is also improving faster than other sectors. Both confirm that logistics remains European investors’ preferred sector.

- Given our base case outlook for inflation and bond yields, we are projecting yield widening to reverse after the 2022-23 repricing. This projected yield tightening is in line with most other sectors in our European coverage.

- In conclusion, our projected 2024-28 annual total return growth for logistics markets improved to 9.3% p.a. compared to Sep-23. Southern Europe and CEE markets are expected to produce the highest returns at 10.3% p.a. and 9.9% p.a., respectively.

MACROECONOMIC CONTEXT PROVIDES TAILWINDS FOR LOGISTICS

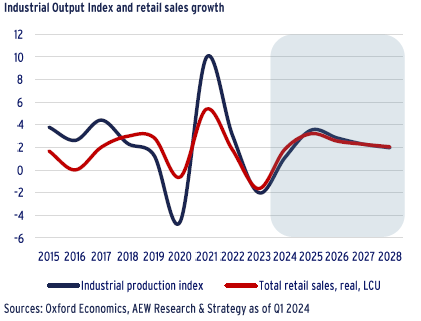

INDUSTRIAL OUTPUT AND RETAIL SALES REBOUND

- Oxford Economics upgraded its Eurozone GDP growth forecast for 2024 to 0.6% and expect inflation to average around 2% this year.

- Although GDP growth was close to stagnant over the past year, their forecasts confirm emerging signs that activity will improve.

- Leading indicators suggest we are near a turning point and cyclical and structural tailwinds are expected to take over. As a result, industrial output growth should gain momentum in 2024.

- Retail sales projections suggest consumer spending will gradually recover by the second half of 2024 as real income growth will pick up more significantly over this year.

- Going forward, industrial output and retail sales growth are expected to return to pre-pandemic levels. These will be supporting fundamental drivers of logistics occupier demand.

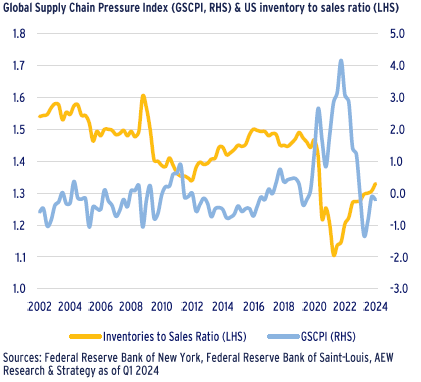

SUPPLY CHAINS NORMALIZE AFTER RECENT DISRUPTIONS

- The Global Supply Chain Pressure Index (GSCPI) integrates transportation cost data and manufacturing indicators to provide a an overview of global supply chain conditions.

- The GSCPI shows that supply chain pressures increased in early 2024. But it remained well below Covid levels suggesting that the impact of Red Sea shipping disruptions on the Eurozone economy should continue to be limited.

- Other data has also been more positive than anticipated, with shipping rates down by about 40% from their peak in late January.

- This normalization is further confirmed by US data as the inventory to sales ratio reached a record low of 1.1 at the height of the pandemic. This ratio has since steadily improved to 1.3 despite remaining well below pre-Covid levels.

- While global supply chain pressures abate, most manufacturers show an increased focus on resilience by adopting nearshoring.

- In the short term, we expect just-in-case operational effectiveness to remain a priority for many retailers and logistics providers.

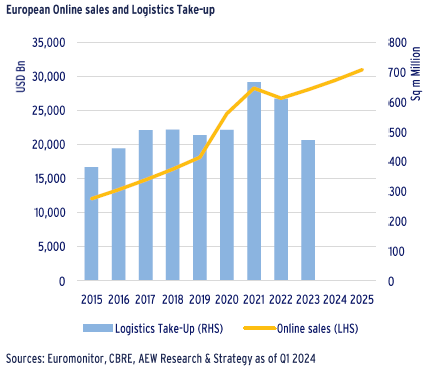

E-COMMERCE TO DRIVE FUTURE TAKE-UP RECOVERY

- The share of European online sales as a share of total retail sales is expected to double to 25% in the ten years to 2032.

- After a rolling series of lockdowns during the pandemic and the lack of open physical retail stores consumers largely shopped online in 2020 and 2021.

- The increase in e-commerce sales resulted in record logistics take-up demand in 2021 and 2022 from dedicated e-commerce and omni-channel retailers.

- As customers returned to physical stores post-pandemic, the growth of online shopping paused in 2022 in continental Europe and decreased in the UK.

- This lagged impact translated into a dip in take-up in 2023, which was further supported by the temporary, high inflation-linked, reduction of discretionary consumer spending highlighted above.

- However, for 2024 and beyond, we expect e-commerce sales to return to their long-term trend. This is expected to support a continued demand for logistics warehouse space in the coming years, regardless of the macroeconomic situation.

OCCUPIER MARKET: SUSTAINABLE AFFORDABILITY AND TAKE-UP EXPECTED TO RECOVER

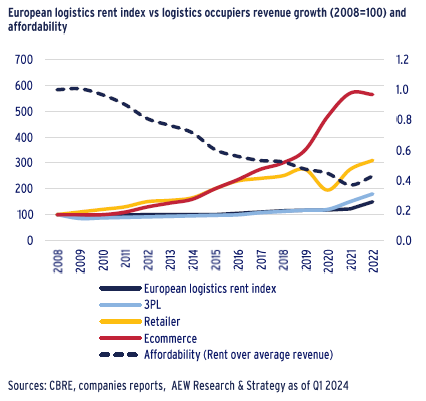

AFFORDABILITY SUSTAINED BY REVENUE GROWTH

- According to CBRE, logistics occupiers' revenues have increased since the GFC albeit at different speeds.

- Revenues from online and brick & mortar sales grew at a relatively similar pace until 2016. But physical store sales were impacted by the Covid-19 related lockdowns while online sales boosted e-commerce retailers' revenues, on the back of increasing inflation.

- European online sales have plateaued in 2022 after the lift of lockdowns but are expected to resume growth by 2024 as many markets, in southern Europe and CEE have not yet reached the level of online penetration maturity.

- In the 15-year period analyzed, from 2008 to 2022, revenues of benchmarked leading e-commerce retailers increased more than fourfold, while a typical retailers revenue grew by 200%.

- During the same period, nominal prime rents have increased by an average of 38% since 2008 in our 39 European logistics markets.

- In short, affordability for occupiers as shown by rents as a share of revenue has improved over the last 15 years.

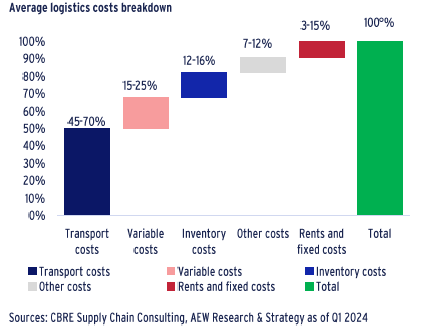

RENTS ARE 3-15% OF TOTAL LOGISTICS COSTS

- According to CBRE estimates, rents represent about 3% to 6% of average operating costs in a logistics supply chain, as illustrated by the graph. The range shows that the share depends on whether it is operated by a 3PL (Third Party Logistics operator), an online retailer or a traditional brick & mortar retailer.

- However, Savills and Hatmills also estimate that in the case of brick & mortar retailers, the rental costs can reach 10-15% of total operating costs, as physical stores rents are also considered.

- The relatively lower share of rents in the operating costs supports the potential for prime rents to increase in strategic locations allowing logistics operators to optimize the overall supply chain costs.

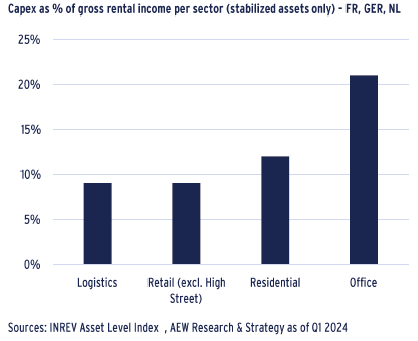

CAPEX LOWEST IN LOGISTICS

- Another factor supporting the affordability of logistics rents is the lower ratio of capex in logistics compared to other types of property such as residential and office.

- Data from the INREV Asset Level Index has estimated capex as a percentage of gross rental income (GRI) for stabilized assets in the main property sectors.

- According to INREV, capex in the portfolio of institutional investors are the highest in percentage of GRI in office and residential at 21% and 12% respectively.

- This might be explained by the average age of buildings in those two asset classes, requiring more investments to prevent obsolescence and meet environmental regulations.

- On the other hand, the logistics stock is relatively more recently built and technically standardized which logically would require less capex, illustrated by the chart.

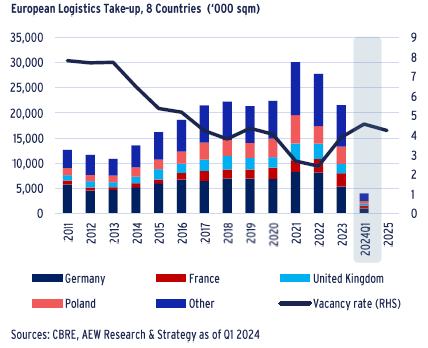

LOGISTICS TAKE-UP SLOWS DOWN FROM RECORD HIGHS

- Logistics take-up in 2023 reverted to lower pre-covid levels, at around 20 million sqm after high levels of 30 and 25 million sqm take-up activity in 2021 and 2022 across Europe.

- As highlighted above, the 2021-22 take-up levels were driven by the surge of e-commerce activity during the pandemic.

- While momentum was maintained during most of 2023, Q4 2023 and Q1 2024 showed a slowdown, with the lowest levels of take-up recorded compared to previous fourth and first quarters since 2015-16.

- As a result of increasing supply and lower demand, the average European logistics vacancy rate increased to 4% in 2023 up from 2.5% in 2022. However, as take-up is projected to recover, vacancy is projected to come down gradually to 3.2% by 2028

- These relatively low levels of vacancy still reflect a broadly undersupplied market, where many occupiers struggle to find appropriate quality space.

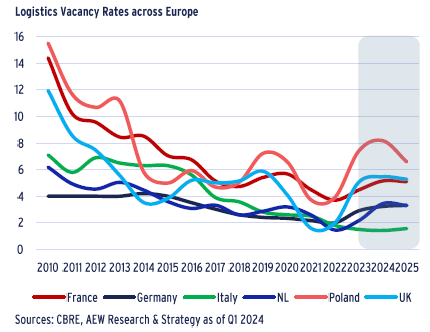

COUNTRY LEVEL VACANCY RATES BETWEEN 2% AND 8%

- New supply responded to the high demand in 2021-22 and in 2023, speculative development increased its share of space under construction, representing nearly 50% of developments.

- However, many logistics developers struggled with profitability in 2022-23 as construction, labour and financing costs all went up while logistics capital values came down.

- With new supply returning in 2024, net absorption is expected to balance the more limited level of future completions, pushing vacancy rates back down across markets.

- Markets with relatively high vacancy, such as Poland and Spain are also expected to benefit from sustained demand.

MOSTLY IMPROVED RENTAL GROWTH OUTLOOK

- As a result of the upward revision of our forecasted macroeconomic indicators our projected 2024-28 annual rental growth for logistics markets improved to 2.7% p.a. compared to Sep-23.

- Across our coverage of 37 markets results are mixed as Southern European markets and Germany show the most resilient figures in terms of rental growth due to higher GDP expectations.

- This is also a result of solid underlying drivers such as the manufacturing sector and shipping and high e-commerce penetration.

- The strongest rental growth improvement is observed in Northern European markets from 2.2% p.a. to 2.8% p.a., making it the third most attractive region for rental growth.

- The CEE markets rank last with a minor decrease in rental growth to 2.4% p.a. as the market seem to have digested the region’s strong rebound over the last few quarters.

INVESTMENT MARKET: CAPITAL VALUES PROJECTED TO BENEFIT FROM YIELD TIGHTENING

2023 DEAL VOLUMES HALVED AS BID-ASK SPREADS PERSIST

- Full year 2023 transaction volumes across the main property types came in at €150bn, just over half of the 2022 full year volumes yet ahead of our Nov-23 estimate of €140bn.

- For full year 2024 we estimate €160bn in investment volumes, with logistics still maintaining a share above 20% of total investments.

- Bid-ask spreads remain high, especially for offices, despite repricing having been steeper and faster than expected.

- Many transactions proceed at lower prices than most sellers’ original reserve prices, as lenders push for refinancings, and fund managers seek to fund investors’ redemption requests.

- Given that 2023 was a relatively good year for stocks and bonds compared to property, we expect a reversal of the denominator effect as real estate’s share of total assets has likely sunk to below most investors’ targets.

- This could trigger investors to increase their real estate investments and re-start their acquisitions to meet these target allocations.

REVIVAL EXPECTED FOR LOGISTICS VALUES AFTER SHARP REPRICING

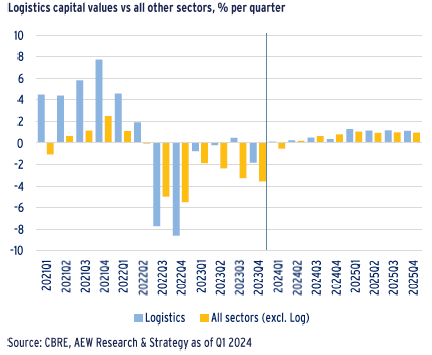

- To contextualize the slowdown in investment volumes, we compare logistics capital value changes versus those for all other sectors over the last three years and the next two years.

- Cumulative capital value decline for logistics vs non-logistics sectors in the current cycle are projected to be -19% and -22%, respectively.

- The logistics sector had a stronger reaction to the interest rate hikes in Q2 & Q3 of 2022 after a period of strong capital gains in years before.

- Many investors are still absorbing ongoing valuation declines and might feel that it is too early for capital values to rebound in 2024.

- Our latest base case projections indicate capital value recovery for logistics to really start in 2025.

- Precisely timing the cycle might still prove challenging as bid-ask spreads remain large despite investor sentiment improving for logistics.

LOGISTICS PRICES STABILIZED AND EXPECTED TO REBOUND QUICKEST

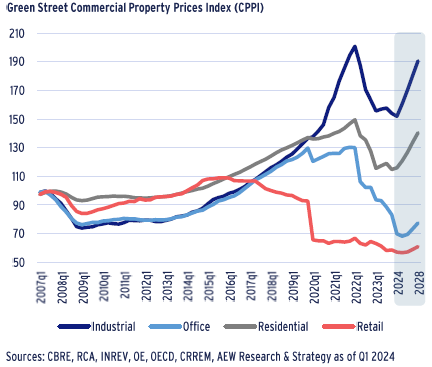

- Prices for European real estate have come down significantly since interest rates increased from Q2 2022. The speed and extent of these declines has varied widely across sectors, as the latest data from Green Street shows.

- Both industrial (logistics) and residential assets showed a decline of over 20% from Q1 2022 to Q1 2023. However, both sectors have since stabilized and are now projected to show rebounds from 2025.

- Offices are estimated to show an even larger decline of over 45% in prices from peak to trough according to Green Street.

- Retail showed a value decline of 13% since Q1 2023. But it has posted a cumulative decline of over 45% since Q1 2016, as e-commerce penetration hit demand for retail space, and retail closures during the pandemic further affected the sector.

SENTIMENT IN LOGISTICS IS IMPROVING FASTER THAN OTHER SECTORS

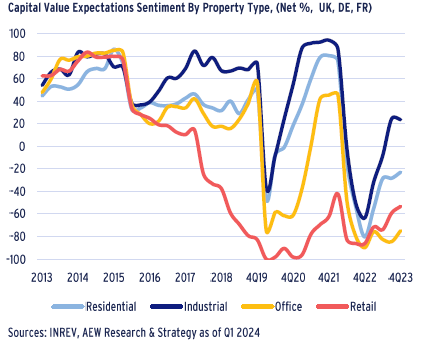

- As a reflection of changes in manager sentiment on European markets, we present the historical results of the quarterly IPE Real Assets Expectations Indicator survey.

- The net percentage (%) shown is calculated as the difference between the share of real estate managers who believe property values would increase vs decrease over the next 12 months.

- Based on this, a value of 0 would indicate a neutral sentiment on the sector’s performance over the next 12 months.

- Our data confirms the dramatic negative impact from the Covid lockdowns in early 2020 and subsequent recovery, as well as the even quicker impact of the rate hikes after Q1 2022.

- Investor sentiment towards the logistics sector has steadily improved since Q4 2022 and is currently the only sector where most of the managers believe the capital values will increase in 2024.

- Recent price and yield stabilization in logistics has probably helped improve this sentiment.

YIELD WIDENING TO REVERSE AFTER 2022-23 REPRICING

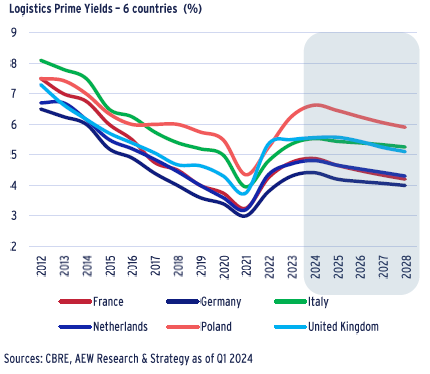

- After the high inflation and rate hikes of 2022 and H1 2023, rates have started to come down and are expected to peak in 2024.

- As inflation eases government bond yields are expected to follow as the market expects between two and three rate cuts in 2024.

- In 2022 and 2023 logistics yields widened dramatically, but they have started stabilizing and are projected to return to their 2018 levels in 2026.

- Across countries, Poland has recorded the highest prime yields in recent years and is expected to reach a high of 6.6% in 2024.

- In 2018-2023, the average prime logistics yield stood at around 4.0%, for France and 3.7% in Germany and are now expected to reach 4.9% and 4.4% respectively before starting to normalize again.

- Logistics remains a relatively low-risk sector for institutional investors, as e-commerce and other fundamental drivers are still providing a solid base for occupier demand.

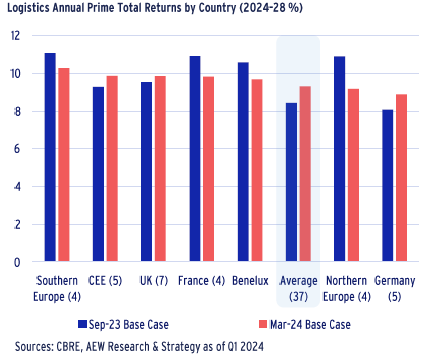

PROJECTED TOTAL RETURNS FOR LOGISTICS IMPROVED TO 9.3% P.A.

- Total returns for logistics markets across Europe are estimated at 9.3% p.a. for the next five years in our Mar-24 base case. This is up 90 bps from our Sep-23 base case as rents improve and yields are still projected to tighten albeit more moderately.

- Southern Europe and CEE markets are expected to achieve the highest total returns at 10.3% p.a. and 9.9% p.a., respectively.

- The improvement is not consistent across all countries with Germany, UK and CEE countries showing an improved outlook, while France, Benelux and the Nordics’ outlook has somewhat declined.

- The timing of repricing in 2022-23 recalibrates the starting capital values in our projections and is the main driver for the outlook change together with the improved rental growth projections.

- Nevertheless, logistics markets covered in our analysis are now expected to see some yield narrowing by the end of the 5-year period, as bond yields are expected to peak in H1 2024 before tightening slowly following this.

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.

Photo credit: FourParx