THE LONG-AWAITED RENAISSANCE OF EUROPEAN RETAIL

- Despite ongoing uncertainty, real retail sales in the Eurozone are projected to grow modestly at 1.7% p.a., outpacing both 1.4% p.a. real GDP and 1.0% p.a. real disposable income growth over the 2025-29 period.

- In-store retail sales in Europe are expected to stabilize with an annual growth rate of around 0.6% p.a. over the next five years. This forecast reflects the projected proportion of e-commerce within total retail sales to 20% by 2029, up from 16% in 2024.

- Prime retail vacancy as reported by INREV has stabilized at 3% in Q3 2024, down from 4% in 2020. However, shopping center vacancy has risen to 6.5% as of Q3 2024. Vacancy for retail warehouses and high street have declined over the past 2-3 years.

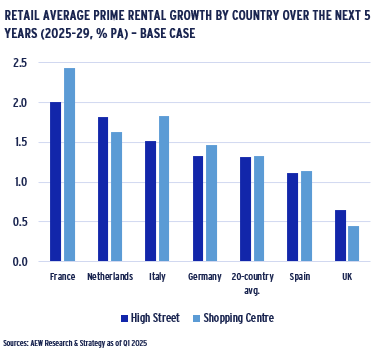

- After double digit declines in 2019-22, European prime rents for both shopping centres and high street retail are expected to return to 1.3% annual growth in 2025-29. At 2.4% and 2.0% p.a., French prime retail rents are projected to lead the way.

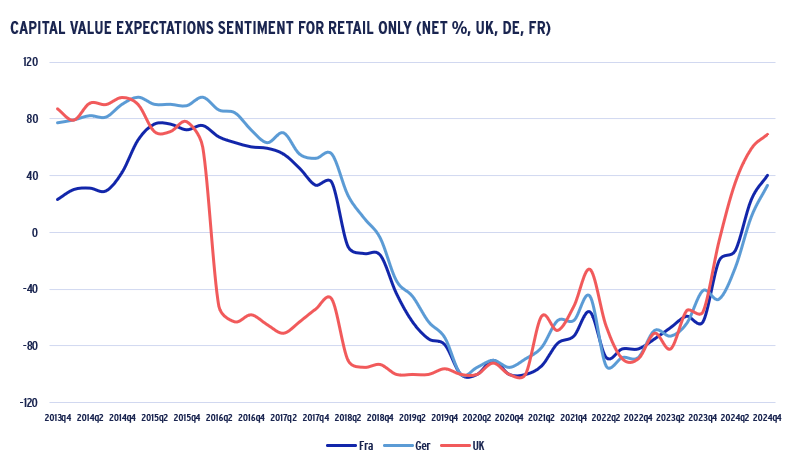

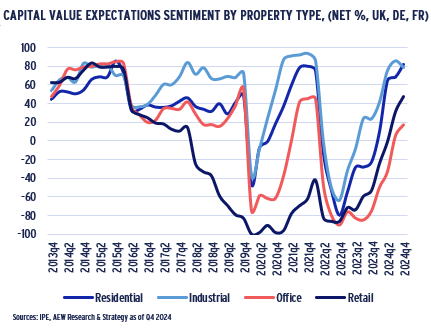

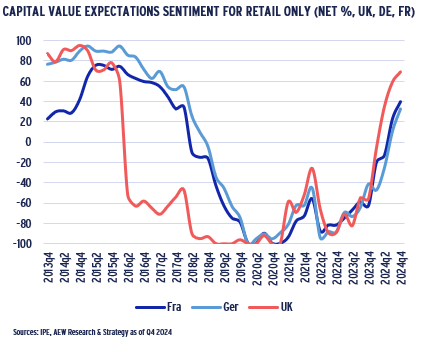

- Manager sentiment towards retail experienced the largest quarterly improvement in Q4 2024, following a prolonged slump in 2015-21. German and French retail sentiment is expected to follow the UK upward lead, similar to post-2015 downward trend.

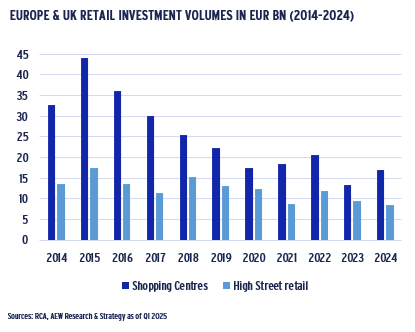

- Retail investment volumes in 2024 have risen to EUR 25.4bn, reflecting an 11% increase from the weak performance in 2023. This growth was primarily driven by shopping centre transactions, which experienced a 27% increase during the period.

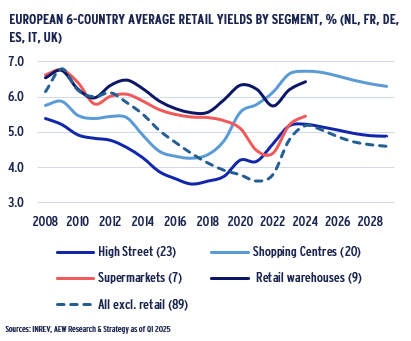

- According to our Sep-2024 forecast, core European shopping centre and high street yields are expected to tighten by 40 and 30 basis points by 2029, respectively, from their 2024 peak levels of 6.7% for shopping centres and 5.2% for high street retail.

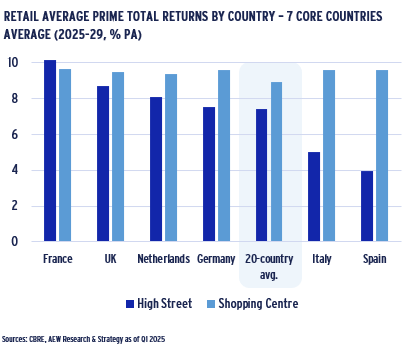

- European prime retail total returns are anticipated to average 8.2% p.a. in 2025-29, with shopping centres at 8.9% p.a., and high street retail at 7.4% p.a. Shopping centre returns are projected to surpass those of high street retail in most countries.

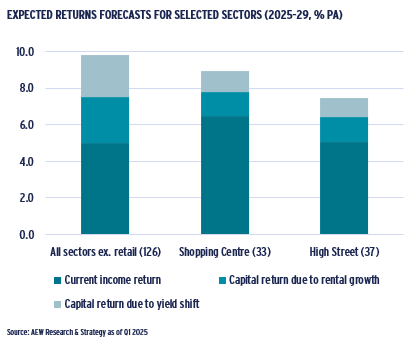

- Retail is projected to offer a higher current income yield of 6.4% and 5.1% in shopping centres and high street compared to the 5.0% average across non-retail sectors, even if total returns trails non-retail sectors.

- Finally, if future property yield tightening becomes less certain -- as government bond yields are now expected to stay higher for longer -- more investors might be interested in the relative safety of European retails’ high current income returns.

MACROECONOMIC DRIVERS

RETAIL SALES REBOUND TO EXCEED GDP GROWTH

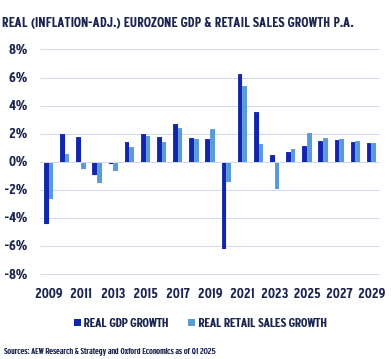

- Over the next five years, Eurozone real GDP is projected to grow at 1.4% p.a. and real retail sales by 1.7% p.a., exceeding the long-term post-GFC trend.

- Retail sales are projected to remain strong as unemployment levels remain generally low even as inflation has eroded household spending.

- This projected growth represents a notable improvement from 2023, when the expiration of COVID-related government support led to a 2% decline in real retail sales.

- Whilst Europe managed to avert widespread recession, consumers experienced a decline in real income, which in turn resulted in negative real retail sales growth in 2023.

- Going forward, some downside risks remain from global geopolitical uncertainties as trade tariffs might become more widespread and armed conflicts remain unresolved.

- Despite these challenges, our base case macroeconomic scenario assumes inflation to remain within the target range enabling central bank rate cuts and a modest GDP recovery.

CONSUMER SENTIMENT STILL CHALLENGING

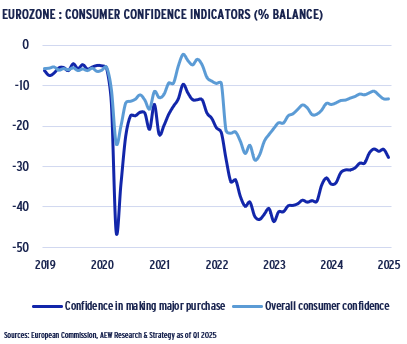

- Examining consumer confidence in the Eurozone more closely offers additional insights into what retailers and investors can anticipate in the future.

- Although there has been a recovery from the lows experienced in early 2023, neither overall consumer sentiment nor major purchase sentiment has returned to pre-COVID levels.

- Overall sentiment reached -12 in Q3 2024 but has recently declined and is still significantly below the 2019 level of -7.

- Confidence in making major purchases, such as homes and cars, remains significantly weaker than overall sentiment.

- This is likely a result of the cumulative effects of recent inflation on purchasing power, as well as interest rates that are well above their historically low levels seen before COVID.

- In our macroeconomic base case, a recession across the Eurozone is expected to be avoided, and unemployment to stay low. This should facilitate sentiment improvement in the future.

RETAIL BANKRUPTCIES RETURNING TO LONG TERM AVERAGES

- Investors find it useful to consider ocupiers’ financial strength.

- In that respect, there could be some concerns on bankruptcies for retail & wholesale businesses which have been slowly returning to 2015 levels.

- This trend might be more skewed towards wholesale business, but lack of more detailed data does not allow us to confirm this.

- Government supports put in place during Covid lockdowns have shown their positive impact in 2020. But as these supports were withdrawn, bankruptcies nearly returned to 2015 levels.

- One category of retail-related occupiers has fared less well as indicated by the increasing and higher level of accommodation and food service bankruptcies in the post-Covid period.

- Again, the combination of accommodation (hotels etc.) and restaurants does not fully allow for retail specific bankruptcies, as accommodation is not typically part of pure retail assets.

- Shopping centres and some retail parks might have some exposure to restaurant occupiers, which could still be impacted.

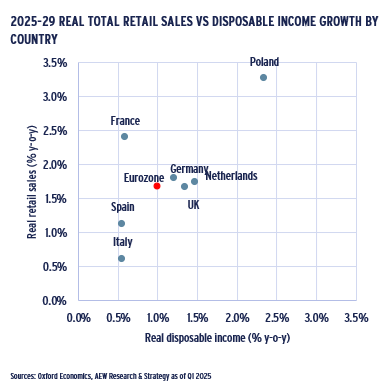

PROJECTED RETAIL SALES AHEAD OF DISPOSABLE INCOME GROWTH

- Projected real retail sales for the 2025-29 period are expected to grow at 1.7% p.a. both in the Eurozone and in the UK.

- These increases might be unsustainable as they are well above the projected growth in real disposable income of 1.0% p.a. for the Eurozone and 1.4% p.a. for the UK.

- In other words, our retail sales projections implicitly assume that households prioritise retail spending over big expenditures like homes or cars, use their savings or take on new debt.

- This is surprising, as higher interest rates and more cautious lending practices from banks make borrowing to finance household discretionary spending less appealing.

- France stands out with the widest gap between its strong 2.4% p.a. projected real retail sales and modest 0.6% p.a. real disposable income growth.

- This might be explained in part by the built-up household savings from the Covid period.

- Even if the gap (between spending and income) for other countries is not as big, it might call into question whether the projected retail sales growth is sustainable in the longer term.

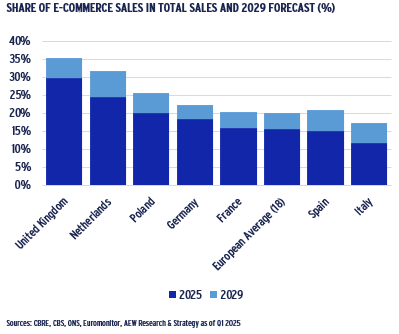

SHARE OF E-COMMERCE TO RISE ABOVE 20%

- Physical retail store sales have been impacted by the ongoing growth of e-commerce over the past decade. As of 2024, e-commerce sales account for 16% of total retail sales.

- Looking forward, this growth trend is anticipated to persist, with the average share of e-commerce retail across 18 European countries projected to increase to 20% by 2029.

- This projected increase marks a return to the slower pre-COVID trend of rising e-commerce penetration, following the record levels achieved during the 2020-21 COVID restrictions.

- As before, the share of e-commerce continues to grow, and it remains uncertain when it will stabilise and at what level.

- Across countries, it can be highlighted that the Netherlands and Spain are projected to see the biggest increase in e-commerce share while Germany is forecast to be well below the average.

- This might be an advantage in the medium term for physical retail assets in Germany relative to other countries.

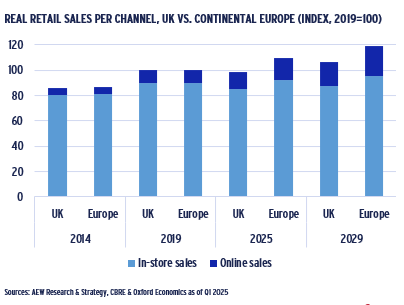

IN-STORE SALES PROJECTED TO STABILISE

- Despite the ongoing rise in e-commerce penetration, real retail sales are still projected to grow at 1.7% per year in 2025-29, indicating that in-store sales are expected to improve.

- The absolute volumes of in-store sales are expected to recover after having declined by 6% in the UK and increased by 3% in Europe by 2025 compared to pre-pandemic levels in 2019.

- The projected cumulative growth in in-store sales over the next five years is over 3% for the UK and over 4% for continental Europe. This equals a stable and modest growth of about 0.6% p.a..

- Online sales are expected to account for 66% of the projected growth in total UK retail sales from 2025 to 2029 while Continental European online sales are projected at 68% of total sales growth.

- In other words, in-store sales are forecast to stabilize at low growth while e-commerce is projected to dominate overall sales growth.

RETAIL OCCUPIER MARKET

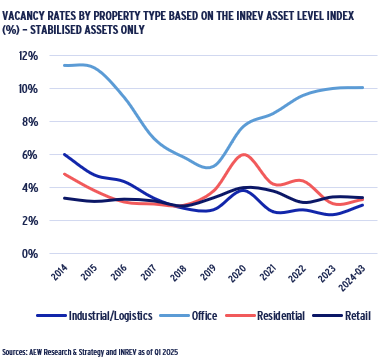

EUROPEAN PRIME RETAIL VACANCY RATE BELOW 4%

- Despite the e-commerce challenges for in-store retailers, the vacancy for retail properties as tracked by the INREV Asset Level Index (ALI) data has remained in a tight 3%-4% range since 2014.

- Vacancy rates across European property sectors have been declining since COVID, except for offices, which have experienced the largest and most persistent increase.

- ALI data shows the performance for institutional investors’ real estate portfolios and the 3% vacancy is most likely reflective of the high quality of (i.e. prime) assets reported to INREV since 2014.

- These low and stable vacancy rates for retail are surprising given the negative investor sentiment that has prevailed for the sector since 2015.

- The overall retail vacancy rate of 3% is likely skewed by the near zero supermarket vacancy rate, which warrants a closer look at retail subsectors.

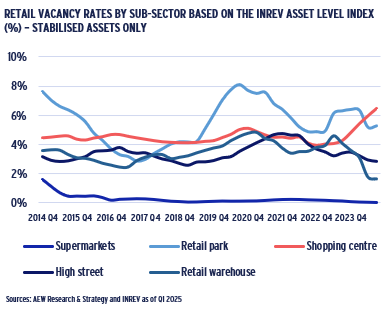

VACANCY TRENDS DIVERGE WITH SHOPPING CENTRES EDGING UP

- More detailed data shows some diverging trends in vacancy rates across different retail sub-sectors.

- Since 2014, reported vacancy rates have remained relatively low with only minor increases during the 2020-21 Covid period.

- These data reflect a concentration of high-quality assets in a small number of countries and are not deemed fully representative for European retail markets.

- The vacancy rate for shopping centers reached 6.5% in Q3 2024, up from 4% in Q3 2023, marking its highest level since 2014.

- This is likely due to national retailers reducing their footprint and retaining space only in the most profitable locations.

- On the other hand, vacancy rates for both retail warehouse and high street retail have trended down over the last 2-3 years.

- The vacancy rate for retail warehouses (incl. furniture, DIY, etc.) was reported at 1.6% in Q3 2024, the lowest level since 2014.

- Finally, multi-tenanted retail parks vacancy rates have been more volatile and remain higher than most other sub-sectors.

MODEST RECOVERY PROJECTED FOR PRIME RETAIL RENTS

- European prime retail rents are projected to grow at an average rate of 1.3% p.a. in 2025-29, which remains below the anticipated inflation rate of approximately 2% during the same period.

- Prime retail rents are starting to grow again, albeit at modest levels, following a significant decline of 16% in shopping centers and 14% in high street retail from 2019 to 2022.

- High variation of prime retail rent growth rates across countries and retail subsectors remains.

- In that respect, France is anticipated to experience the highest prime rental growth in both shopping centers and high street retail, with rates of 2.4% and 2.0% per year, respectively.

- On the other hand, UK’s shopping centre and high street retail rental growth are notably below the European average at 0.4% and 0.7% p.a., respectively.

- Finally, bifurcation between prime and secondary high street retail is expected to remain for some time to come, with secondary rents recording -5% annual rental growth while prime rents moderated by -0.6% p.a. over the 2021-24 period.

RETAIL INVESTMENT MARKET

RETAIL SENTIMENT IMPROVES AFTER LONG SLUMP

- In Q4 2024, retail experienced the largest quarterly improvement in manager sentiment among all four sectors, following a prolonged slump lasting eight years.

- In fact, 2024 shows a strong improvement in European managers’ sentiment across all sectors based on the latest IPE Real Assets Expectations Indicator survey.

- Our chart shows the net percentage (%) calculated as the difference between the share of real estate managers who believe property values would increase vs decrease over the next year.

- Based on this, a value of 0 would indicate a neutral sentiment on the sector’s performance over the next 12 months.

- The improvement in retail sentiment is likely a result of the substantial repricing of retail assets that started before 2022, unlike in most other sectors.

- Retail assets that managed to survive the e-commerce challenges have become attractive to investors once more.

UK TOPS INVESTOR SENTIMENT FOR RETAIL

- At 69, UK retail stands out as attracting the most positive investor sentiment well ahead of France at 40 and Germany at 33.

- The improvement in UK retail sentiment is spectacular from -56 in Q4 2023 to +69 in Q4 2024.

- Investor sentiment for UK retail has preceded changes in French and German retail investor sentiment.

- This was also the case in 2015 when the UK started its prolonged period of very poor investor sentiment.

- This earlier UK decline was likely triggered by oversupply of retail space and the earlier adoption of e-commerce in the UK, as well as the result of Brexit referendum.

- In Q1 2019, even before the COVID pandemic, UK retail sentiment reached its lowest point at -100 and remained there for two years.

- German and French retail sentiment lagged behind the UK and also fell to -100 by Q1 2020. Their recent recovery is once again trailing the UK, albeit with some delay.

2024 RETAIL VOLUMES UP 11% FROM 2023 LED BY SHOPPING CENTRES

- As sentiment has improved, retail investment volumes in 2024 have rebounded from a weak 2023, totaling EUR 25.bn, with 67% of that volume coming from shopping centers.

- This is an 11% increase from the record low of EUR 22.8bn in 2023, but only 41% of the record volumes reached in 2015.

- Shopping centres posted a 27% increase in 2024 y-o-y.

- High street retail volumes show slightly more stability, currently at 49% of their record level of EUR 17.4bn reached in 2015.

- This might be due to some (luxury) high street retail occupiers looking to acquire their rented stores providing an additional source of investment capital for high street retail.

- Multi-tenanted shopping centers are less likely to attract similar investment interest from occupiers.

- Another challenge with secondary shopping centers is that they may have experienced higher vacancy rates and have been more difficult to sell.

CORE RETAIL YIELDS PROJECTED TO TIGHTEN 30-40 BPS BY 2029

- Our latest Sep-24 projections, imply a tightening of European shopping centre and high street yields by 40bps and 30bps by 2029 from their 2024 peaks of 6.7% and 5.2%, respectively.

- Similar to other sectors, our projected retail yield tightening is driven by government bond yields forecasts in turn triggered by recent and expected ECB rate cuts as inflation has eased.

- Compared to other sectors, current retail yields reflect a much earlier widening compared to other property types, starting in 2017. This trend is expected to moderate in the next five years.

- However, prime retail yields are projected to remain above historical averages, reflecting the expectation of elevated bond yields and interest rates for the next five years.

- Supermarket yields tightened during COVID, as they offered strong stability. Out-of-town retail warehouse yields also tightened during Covid as access was unrestricted.

- Both of these retail sub-sectors have seen a normalization of yields, even if no forecasts are yet available.

FRENCH RETAIL RETURNS TO OUTPERFORM AT AROUND 10%

- European prime retail total returns are projected to average 8.2% annually over the next five years, with shopping centres at 8.9% p.a. and high street retail at 7.4% p.a. over the same period.

- Shopping centre returns are expected to exceed high street returns in most countries, with the notable exception of France.

- In fact, French retail markets are projected to outperform other European countries driven by its strong high street retail returns of 10.2% p.a. over the next five years.

- This outperformance in France is likely due to prime high street benefitting from a tourism rebound and its focus on luxury as well as a strong diversity and quality of its central Paris high streets.

- Despite below average rental growth, UK returns are coming out strong as UK prime yields remain ahead of other markets.

- Maintenance capex are not included in our prime returns. Net returns are impacted, especially as Green Street estimates European shopping centre capex at 27% of net operating income.

RETAIL OFFERS ATTRACTIVE INCOME RETURNS

- At 8.9% and 7.4% p.a., our forecasts for shopping centres and high street retail still compare unfavorably with non-retail sectors, where the average prime returns are expected at 9.8%.

- However, retail sectors are offering a higher current income yield of 6.4% and 5.1% in shopping centres and high street compared to the 5.0% average across non-retail sectors.

- Projected capital returns for retail are more moderate compared to non-retail sectors. These are dependent on the forecasted yield compression and rental growth.

- In this respect, we note that capital return from rental growth for non-retail sector is projected at 2.5% p.a. almost double the average at 1.3% p.a. in both high street and shopping centres.

- Finally, the forecasted capital return from future yield shift for non-retail sectors is 2.3% p.a. again nearly double the 1.2% and 1.0% p.a. for shopping centres and high street retail, respectively.

- If future property yield tightening becomes less certain -- as bond yields are now expected to stay higher for longer -- the relative safety of retails’ high current income is more appealing.

This material is intended for information purposes only and does not constitute investment advice or a recommendation. The information and opinions contained in the material have been compiled or arrived at based upon information obtained from sources believed to be reliable, but we do not guarantee its accuracy, completeness or fairness. Opinions expressed reflect prevailing market conditions and are subject to change. Neither this material, nor any of its contents, may be used for any purpose without the consent and knowledge of AEW. There is no assurance that any prediction, projection or forecast will be realized.